EUR/USD

The Euro stalled below 1.3180 against the dollar during Wednesday and retreated to re-test lows below 1.31 early in the US session with weak German industrial orders data undermining sentiment. German Finance Minister Schauble also stated that he had talked openly with Greek officials about a Euro exit.

There was further uncertainty surrounding the Greek situation as the PSI acceptance deadline drew closer. There were inevitably mixed comments during the day with markets taking a cautious tone. Although there were widespread expectations that the threshold for avoiding default would be reached, there were uncertainties surrounding the threat of collective action clauses being implemented which would be likely to trigger a credit event.

The Spanish decision to target a higher budget deficit for 2012 continued to have political ramifications and stresses amid speculation that there could be wider Euro-zone dissent against the fiscal compact. There was also caution surrounding the ECB meeting on Thursday even though markets were expecting the central bank to keep policy on hold this month.

The US ADP employment report was broadly in line with expectations with private-sector payroll growth estimated at 216,000 for February from a revised 173,000 the previous month. The data helped maintain a degree of optimism surrounding Friday’s employment report and supported US yields.

The dollar failed to gain significant advantage, especially after a media report that the Federal Reserve could consider some form of additional quantitative easing within the next few months. There was also evidence of Euro short covering following the inability to push the currency through the 1.31 level and it moved back to the 1.3180 area in Asian trading on Thursday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support in the 80.60 region against the yen during Wednesday and advanced following the US ADP employment data as optimism surrounding the US payroll data was sustained.

There was also a recovery in risk appetite during the New York session which curbed demand for the Japanese currency as the dollar pushed above the 81 level.

The current account data was weaker than expected with the seasonally-adjusted surplus sliding close to zero while the fourth-quarter GDP data was revised to -0.2% from -0.6% previously. The dollar pushed to a peak near 81.40 as defensive yen demand also eased slightly.

Sterling

Sterling was unable to move above 1.5750 against the dollar on Wednesday and dipped to test support close to 1.57 before finding some degree of support as wider dollar moves dominated. The UK currency edged weaker to the 0.8360 area against the Euro.

There were little in the way of fresh domestic incentives during the day, especially with caution surrounding the Euro-zone. Sterling was hampered by a generally downbeat assessment of the banking sector which reinforced the longer-term economic risks.

The Bank of England started its meeting on Wednesday and the latest policy decision is due to be announced on Thursday. There is a strong probability that policy will be left on hold following last month’s move to expand quantitative easing. Given the very low level of expectations, there will be a substantial Sterling move if there is a surprise announcement. Sterling nudged higher on Thursday as the US currency was generally weaker.

Swiss franc

The dollar was again blocked in the 0.92 level against the franc on Wednesday and edged back to the 0.9160 region during the New York session. There were no significant moves in the Euro as it was trapped close to the 1.2050 region.

The National Bank confirmed that interim Chairman Jordan had been cleared following an investigation surrounding currency transfers and there were no significant franc movement on the news. Markets will look to see if there is any permanent appointment of Jordan which would be likely to increase market confidence in the minimum Euro level.

There will still be the risk of disruptive capital flows into the Swiss currency if there is any failure of the Greek PSI deal.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

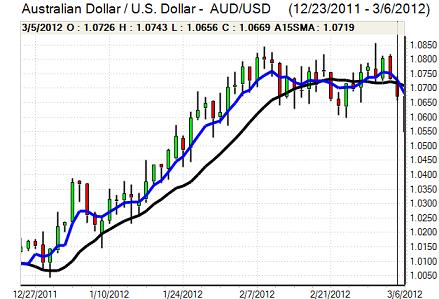

Australian dollar

The Australian dollar again found support on dips towards the 1.05 level against the US dollar during Wednesday and rallied to the 1.0580 region as wider risk appetite improved and selling pressure following the weaker domestic GDP data started to dissipate.

The labour-market data was weaker than expected with a decline of 15,400 in February from a revised 46,200 increase previously with unemployment rising to 5.2%. The currency recovered from an initial slide and nudged over the 1.06 level as global risk conditions were slightly firmer on expectations that Greece would be able to avoid a default.