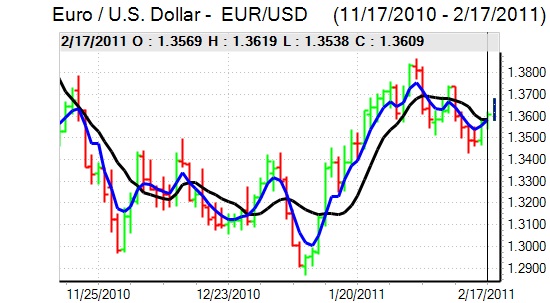

EUR/USD

The dollar failed to gain any traction during the past 24 hours and weakened steadily with lows just beyond 1.3620 against the Euro. There was a spike in risk aversion during Thursday with fresh reports that Iranian Naval vessels would move through the Suez Canal and further political protests in North Africa and the Middle East. The dollar again failed to derive any benefit from a decline in risk appetite due in part to market optimism over the global growth outlook.

The US data recorded an increase in jobless claims to 410,000 in the latest week from a revised 385,000 previously, but the Philadelphia Fed index rose strongly to 35.9 for February from 19.3. The consumer prices data was slightly stronger than expected with a 0.4% headline increase while core prices rose 0.2%. The inflation data will give some ammunition to the Fed members looking for an early end to further quantitative easing, but there will still be expectations that a majority of the FOMC will remain committed to the current policy.

There was further speculation that Portugal would need Euro-zone support within the next few weeks and there was also increased uncertainty over the banking sector. There were rating downgrades for regional German banks and there was also a sharp increase in emergency lending from the ECB. The impact will be limited if this was a one-off event, but the Euro could be much more vulnerable if there is a sustained increase in borrowing from the ECB.

The dollar was still unable to secure any support in Asia on Friday and was trapped just beyond the 1.36 level.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was unable to make a further attack on the 84 level against the yen during Thursday and dipped to lows near 83.20 during the US session. There was a decline in US yields which had a negative impact on the dollar although technical factors were a key influence.

Global equity markets maintained a robust tone and this helped curb wider demand for the Japanese currency. There will still be expectations of capital repatriation flows over the next few weeks which will underpin the yen.

The G20 meetings will be watched closely over the next two days and strong calls for a faster pace of Chinese yuan revaluation could have some impact in strengthening the yen against the dollar.

Sterling

Sterling found support below 1.61 against the dollar during Thursday and advanced to a peak just above 1.6180 as the US currency came under wider pressure.

The latest CBI industrial survey recorded an improvement to -8 for January from -16 the previous month and there was another very strong reading for prices.

Interest rate expectations inevitably remained a very important focus and MPC member Sentence maintained his call for policy tightening with comments that a series of interest rate increases were required to bring inflation back under control and keep expectations under control. The February MPC minutes will be watched very closely next week to see how close the Bank of England was to raising rates and to assess the potential timing of any future increase.

The banking sector will continue to be watched closely and there will be some fears that any move by a new Irish government following the February 25th general election to force international banks to accept debt write-downs would have a negative impact on the UK sector and Sterling.

Swiss franc

The dollar failed to break above 0.9620 against the franc on Thursday and was subjected to renewed selling pressure in US trading with a sharp retreat to test support below 0.95. The Euro also weakened to a low close to 1.29 against the Swiss currency as there was a fresh spike in fears over the Middle East situation. Safe-haven considerations will remain very important for the franc.

Domestically, the ZEW business confidence indicator improved slightly to -17.2 from -18.4 previously, but there will still be unease over the competitive situation. Further strong franc gains would also renewed fears over deflationary pressure and increase pressure on the central bank.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Australian dollar

The Australian dollar held just below 1.0050 against the US currency during European trading on Thursday and then pushed sharply higher in New York with a high above 1.0120. There was wider selling pressure on the US currency and there was also support from generally firm equity prices.

Underlying confidence in the Australian dollar remains strong and there will be further strong buying support on dips. There will, however, also be unease over the domestic economy and the possibility of a sharp slowdown if the housing sector comes under pressure.