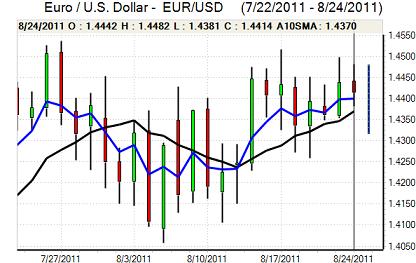

EUR/USD

The Euro again moved higher during the European session on Wednesday with support below the 1.44 area against the dollar. There were further reports of Euro buying from Asian central banks as part of their underlying reserve management operations, although there was also a suspicion that they were looking to trade recent ranges on a short-term basis.

The German IFO index was significantly weaker than expected with a decline to 108.7 for August from 112.9 previously which was a 10-month low. Although still high in historic terms, the pace of decline will cause concerns as it suggests that the economy could be losing momentum very quickly. The Euro-zone industrial orders data was also slightly weaker than expected with a 0.7% monthly fall.

There was evidence of further tensions within money markets as dollar Libor rates continued to move higher. There were further stresses surrounding the Banking sector as credit-default swaps continued to rise, although there was a rally in share prices after recent selling. There was relief that there were no bids in the ECB emergency dollar liquidity facility and the Bundesbank was confident that repo operations could keep market tensions at bay.

There were still political stresses surrounding the bailout payments to Greece with controversy surrounding Finland’s request for collateral while German opposition to Eurobonds continued.

The US durable goods orders data was stronger than expected with an increase of 4.0% for July following a revised 1.3% decline the previous month while there was a core increase of 0.7%. The data helped ease immediate fears over the economy and there was some reduction in speculation surrounding a signal of fresh quantitative easing by the Fed Chairman Bernanke in his speech on Friday.

There was also a covering of short dollar positions which pushed the Euro back to below the 1.44 level where solid buying support again emerged.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar again found support close to 76.50 against the yen on Wednesday and pushed significantly higher during New York trading. There was initial relief following the stronger than expected durable goods data which pushed the US currency stronger as US Treasury yields moved higher. There was also reduced speculation over further quantitative easing which helped underpin the dollar.

There was no evidence of intervention, but markets remained very nervous over the situation, especially with hints from Japan that more aggressive policy measures could be considered.

The dollar edged above the 77 level, but was still encountering tough resistance with a general lack of confidence in the global economy maintaining some defensive yen demand.

Sterling

Sterling was again unable to hold gain above 1.65 against the dollar on Wednesday and dipped sharply during the US session with lows near 1.6350 as stop-loss selling increased.

The latest Nationwide consumer confidence index recorded a decline to 49 for July from 51 previously. Although this was slightly better than expected, there will be persistent fears surrounding the UK economy as growth remains extremely weak and there was some speculation over a downward revision to the second-quarter GDP data which is due for release on Friday.

Sterling also attracted reduced defensive support during the day with a suspicion that recent buying had been excessive while the US data also triggered a flow of funds back towards the dollar. Liquidity will remain low in the short term, especially with a UK market holiday on Monday which will maintain the risk of high volatility.

Swiss franc

The dollar failed to make a move above 0.7950 in Europe on Wednesday and dipped to lows below 0.79 in the New York session as the Euro also failed to hold the 1.14 level.

There was renewed franc selling during the US session with a further test of resistance above 0.7950. The US data improved the risk appetite environment which curbed demand for the franc on defensive grounds.

There was also further speculation that the National Bank would take further aggressive action to weaken the Swiss currency as market conditions remained choppy.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Australian dollar

The Australian dollar found support below 1.0450 against the US currency on Wednesday and briefly pushed back above the 1.05 level, but it was unable to sustain the gains and there was a further test of support below 1.0450 in Asia on Thursday.

The currency found it difficult to secure gains from an improvement in risk appetite following the US data as underlying confidence in the global growth outlook remained weaker, especially with Euro-zone demand lower. There were also increasing doubts surrounding the domestic economy which curbed demand for the currency with some reduction in speculative long positions also a feature.