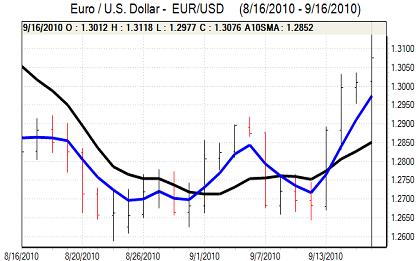

EUR/USD

The Euro found support below 1.30 against the dollar during Thursday and maintained a generally firmer tone during the session as the dollar remained on the defensive. There were persistent reports of central bank buying which also helped underpin the currency.

The Euro drew support from a firm demand at the latest Spanish debt auction which helped lessen immediate fears surrounding deficit financing stresses and also encouraged a modest narrowing of yield spreads. From a longer-term perspective, there was no agreement on financial penalties for missing EU budget targets and there are still important Euro vulnerabilities.

The US growth-related data was mixed during the session. The jobless claims data again recorded a slightly stronger than expected figure with claims declining to 450,000 in the latest week from a revised 453,000 the previous week. The Philadelphia Fed survey improved from the August reading, but there was still a second successive figure below zero at -0.7 and the orders component was at the weakest for over 12 months which will maintain unease over growth trends.

The US capital account position will also be watched closely and net long-term inflows increased to US$61.2bn from US$44.4bn the previous month. Solid net flows will help offset the potential impact of a wider current account deficit for the second quarter and should curb dollar selling to some extent.

The Euro pushed to a high just above 1.31 against the dollar before stalling as central bank buying for the currency faded.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

There was no evidence of further Bank of Japan intervention during Asian trading on Thursday and the yen gained support from exporter selling. There was also some speculation over capital repatriation back to Japan and dollar retreated to the 85.30 area. There was still caution over yen buying given the threat of further official action.

Trading ranges remained narrower during the remainder of Thursday as markets considered the next potential move. The US data provided some net support to the dollar and it nudged to a high around 85.80 with some further paring of long yen positions.

There was further US criticism of China’s economic policies and this will also reinforce expectations that the US will not support Japanese intervention on the yen which will tend to lessen the effectiveness of Bank of Japan action.

Sterling

Sterling drifted weaker in early Europe on Thursday with selling pressure above 1.5650 against the dollar.

The UK economic data was weaker than expected with a surprise 0.5% decline in retail sales for September compared with expectations of a further monthly increase. This was the first decline since January and, although the series is volatile, there will be some renewed doubts over consumer spending trends which will also unsettle Sterling.

The latest CBI industrial trends survey was also weaker than expected with a decline to -17 from -14 and underlying confidence in the economy is likely to remain weaker.

Sterling still gained some protection from a lack of confidence in the dollar and it was able to regain the 1.56 level later in the US session. The Euro strengthened to a 7-week high against Sterling near 0.84 before correcting slightly weaker.

Swiss franc

The franc edged slightly weaker ahead of the National Bank policy meeting on Thursday. The central bank held interest rates at 0.25% following the quarterly meeting which was broadly in line with expectations even though there had been some speculation over a rate increase.

The bank stated that growth had slowed markedly and the underlying tone was significantly more pessimistic than expected. The bank also lowered its inflation forecasts which dampened any expectations of a near-term monetary tightening.

The bank tone triggered sharp selling pressure on the Swiss currency as the Euro rallied to a high of 1.33. The dollar also gained ground with an advance to the 1.0160 area with a reduction in defensive demand for the franc.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

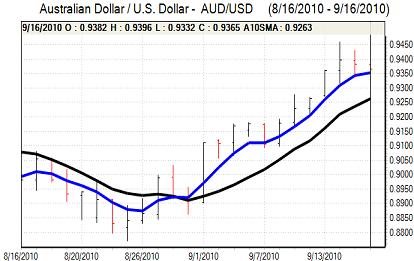

Australian dollar

The Australian dollar was unable to regain the 0.94 level against the US dollar on Thursday and dipped to lows near 0.9330 before finding support. There was still solid buying interest on retreats and the currency consolidated just above 0.9350.

International risk appetite was still solid, but there was some evidence of profit taking after recent firm gains for commodity currencies. There were also fresh doubts over the global growth outlook following the Swiss National Bank meeting which dampened demand for the Australian dollar.