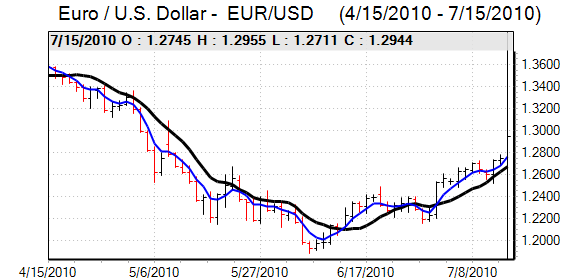

EUR/USD

The Euro found support close to 1.27 in Asian trading on Thursday as underlying technical support for the currency remained firm.

There was further relief surrounding the European bond auctions with a successful Spanish sales reinforcing the mood of greater optimism towards the Euro-zone and the Euro. Better than expected results from JP Morgan also helped underpin risk appetite.

The US data was again weaker than expected with a particular focus on the industrial sector. The New York manufacturing index declined to 5.1 for July from 19.6 the previous month and the Philadelphia Fed index also dipped to 5.1 from 10.0. Industrial production rose 0.1% for June which did not have a significant impact. With a deterioration in business confidence there were further fears that the US economy would slow significantly over the second half of 2010.

There was a 0.5% decline in producer prices for June which reinforced market expectations that the Federal Reserve could take additional steps to support the economy later in 2010. The dollar suffered from a lack of yield support and remained under pressure against the major currencies as it also struggled to gain defensive support.

The Euro continue to challenge dollar support levels and the Euro pushed to fresh two-month highs above 1.29 against the dollar in New York trading.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The Japanese currency maintained a firmer tone on Thursday on fears over a sharp slowdown in the Chinese economy following an official report warning over second-half prospects and confidence was only partially restored following the release of the second-quarter data which recorded growth of 10.3% from 11.9% in the first quarter and a lower than expected inflation rate of 2.9%.

Domestically, the Bank of Japan held interest rates at 0.10% following the latest MPC policy meeting and it also upgraded its economic assessment with a slightly more optimistic tone in the statement, although changes in tone were limited. The dollar remained generally on the defensive and there was a further test of support close to the 88 region.

The US currency was unable to secure any recovery in US trading and retreated to lows near 87.20 before a tentative recovery to the 87.50 area as there was speculation over yen selling at lower levels.

Sterling

The UK currency maintained a firm tone in early Europe on Thursday as there was solid support below the 1.5250 area against the US dollar.

Sentiment towards the UK currency was boosted by comments from US pension fund PIMCO that it now considered UK bonds more attractive. These comments will help maintain expectations of capital inflows and also help reduce fears surrounding sovereign debt which should underpin Sterling.

MPC member Miles commented on Thursday that the time was not right for an increase in interest rates. Markets will continue to watch comments from Bank officials closely as uncertainty over near-term prospects will persist. There will still be expectations that the bank will not be in a position to increase interest rates significantly will tend to dampen Sterling support.

A weak dollar continued to underpin the UK currency and Sterling pushed to fresh 10-week highs above 1.54 against the dollar in US trading as the UK currency found support close to 0.84 against the Euro.

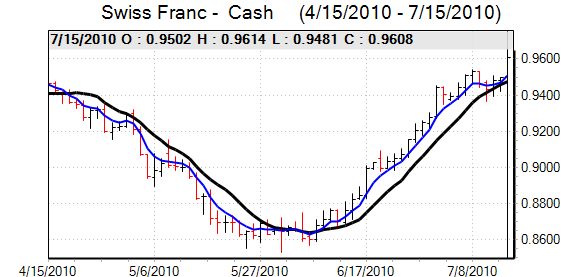

Swiss franc

The dollar was unable to regain levels above 1.0550 against the franc on Thursday and retreated to a 5-month low of 1.04 in US trading, primarily reflecting wider selling pressure on the dollar. There was solid demand for the Euro against the franc with a move to the 1.3470 area.

A further solid debt auction within the Euro area helped curb defensive demand for the Swiss currency. There was some speculation that National Bank Chairman Hildebrand could be replaced after the central bank registered heavy paper losses on its currency intervention and this had a mixed impact on the franc with some speculation that the bank would face strong opposition to further Euro buying.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Australian dollar

There was further Australian dollar selling pressure in local trading on Thursday with the Chinese data unable to dispel doubts over China’s economy and there was a low near 0.8750 against the US currency.

There were volatile trading conditions in European and US trading on Thursday as contradictory influences persisted. The Australian dollar drew support from a weaker US currency, but there were persistent doubts surrounding the global economy. There were Australian dollar lows below 0.8750 before a recovery back above the 0.8830 level as US dollar weakness dominated.