EUR/USD

The Euro found support on dips towards 1.40 against the dollar during Wednesday and initially hit resistance close to 1.41 before drifting weaker. The US currency came under further pressure during the New York session with the Euro pushing to a high above 1.4270.

In testimony to the US House of Representatives on the semi-annual monetary report, Fed Chairman Bernanke remained generally downbeat over the economy with warnings that the period of economic weakness was lasting longer than expected. Bernanke also stated that the monetary policy was open, but also that the Fed would consider providing more monetary stimulus if the economy deteriorates further. The comments will reinforce speculation that there could be further quantitative easing which also put the dollar firmly on the defensive.

Dollar sentiment was undermined further by Moody’s announcement that it was putting the AAA credit rating under review for a possible downgrade due to the potential default risk associated with failure to raise the debt ceiling. The move undermined confidence and the impact was magnified by the fact that there was no progress in the debt-ceiling negotiations. There were reports that there were acrimonious discussions between Obama and Congressional negotiators as the Treasury’s August 2nd deadline pushed nearer.

The sense of panic surrounding the Euro-zone continued to ease slightly during the day as yield spreads on peripheral debt narrowed, but underlying confidence remained extremely fragile with no moves towards finding a durable solution. There were further tensions surrounding Greece with Germany resisting efforts for further summits to discuss the solution. Discussions are due on Friday and tensions were also high ahead of the Euro-zone bank-stress tests which are also due on Friday while Fitch downgraded Greece’s credit rating.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was unable to regain the 80 level against the yen during Wednesday and came under further selling pressure during the US session with a further test of support towards 78.50. Bernanke’s dovish comments and hints over the possibility of further monetary stimulus undermined support for the dollar on yield grounds.

A persistent lack of confidence in the Euro-zone and US fundamentals also triggered defensive demand for the Japanese currency.

Finance Minister increased verbal rhetoric against yen gains with a warning that the yen’s rise did not reflect fundamentals. There were serious doubts whether G7 would back concerted intervention with the moves following March’s earthquake seen as exceptional circumstances, but the dollar did spike higher late in Asia on Thursday due to suspected Bank of Japan intervention

Sterling

Sterling initially hit resistance close to 1.60 against the dollar on Wednesday and weakened following the latest labour-market data. The claimant count increased by 24,500 for June, the largest increase for over two years. Although there were distortions within the data, the data reinforced fears over a lack of growth in the UK economy. There will also be fears that the unemployment rise will increase strains on the budget position as welfare commitments increase.

The Office of Budget Responsibility (OBR) warned that the fiscal position was unsustainable and that further policy tightening would be required over the next few years.

The Euro-zone debt crisis and implications for the UK economy also remained under close scrutiny. Markets at this stage are still seeing some defensive qualities for Sterling as there has been no negative impact on UK bond yields. Sentiment could still reverse rapidly over the next few weeks.

Dollar moves dominated during the US session and Sterling rallied sharply to a peak near 1.62 following Moody’s announcement that the US AAA rating would be put under review.

Swiss franc

The Euro failed to gain any further relief against the franc during Wednesday and from a high above 1.17, retreated to fresh record lows below 1.15 before finding some support. The US currency also came under heavy selling pressure and fell sharply to fresh record lows below 0.81 as confidence in the Euro and dollar collapsed, triggered renewed safe-haven flows into the Swiss franc.

National Bank member Jordan stated that he was very concerned about the franc developments and insisted that the bank could take action if there was any threat to price stability. These comments appeared to be in conflict with weekend comments by bank president Hildebrand. The bank has rejected any move to link the currency with the Euro.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

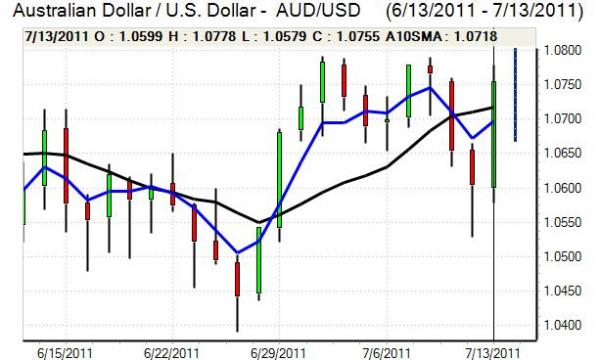

Australian dollar

The Australian dollar found support below 1.0650 against the US currency during Wednesday and rallied sharply during the New York session following comments from Fed Chairman Bernanke. There was a brief surge in risk appetite following hints over a further relaxation of monetary policy and the Australian dollar also gained support on yield grounds with a high just above 1.0780 before drifting weaker.

A small increase in inflation expectations did not have a major impact with markets still focussed very strongly on international developments and risk appetite.