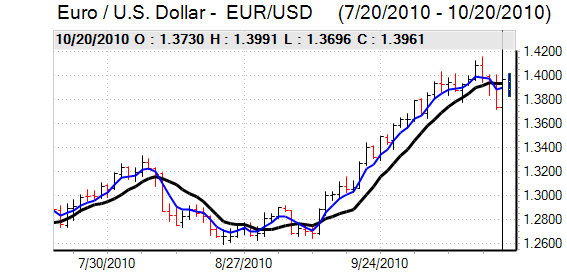

EUR/USD

After pushing to a high just beyond 1.37 against the Euro, the dollar was subjected to renewed selling pressure on Wednesday and retreated very sharply to lows beyond 1.3950.

The issue of Federal Reserve quantitative easing remained very important and there was speculation over a much bigger than expected US$500bn Fed package following the release of a report from an influential advisory group, reportedly with sources close to the central bank.

Following the report, there was also an improvement in risk appetite which spurred additional demand for the Euro and lessened dollar demand. There was also evidence of fresh interest in commodity currencies which unsettled the US unit as interest in carry trades resumed.

The Federal Reserve Beige Book stated that growth in the economy remain generally weak in most districts which reinforced speculation that there would be additional easing by the central bank. There were comments from the more hawkish Fed members that additional quantitative easing would be ineffective, but markets will assume that there will be further measures in November which will undermine dollar sentiment.

US Treasury Secretary Geithner stated that currencies were now in equilibrium and that no further weakness in the dollar was justified. The comments triggered some fresh dollar support in Asian trading on Thursday with a temporary move to the 1.3850 area as volatility remained high. Markets will remain on high alert for official comments ahead of the G20 meetings at the end of the week.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was unable to make any headway during Wednesday and came under fresh selling pressure later in the US session with fresh 15-year lows below the 81 level.

There was some reluctance to push the US currency weaker in case it triggered fresh Bank of Japan intervention and the dollar briefly spiked to a high around 81.80 in Asia on Thursday with some rumours of central-bank moves. The dollar was unable to sustain the advance and weakened back to the 81 area as yield support remained weaker.

The Chinese economic data was broadly close to expectations with a GDP figure of 9.6% and risk conditions were broadly stable following the batch of releases. There will be further reservations over aggressive speculative moves ahead of the G20 meetings.

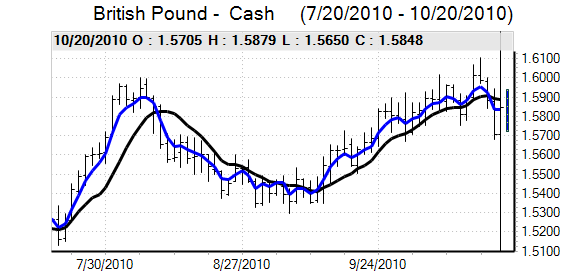

Sterling

Sterling found support below 1.57 against the dollar and rallied during Wednesday, although the primary influence was strong selling pressure on the dollar rather than enthusiasm for Sterling.

The latest Bank of England minutes recorded a 7-2 vote for keeping interest rates and quantitative easing unchanged in October. Sentance again voted for an increase in interest rates of 0.25% while Posen voted for an increase in the amount of quantitative easing to GBP250bn from GBP200bn.

Expectations that the central bank would move close to further easing over the next few meetings pushed Sterling down to lows near 1.5650 against the dollar.

The government spending cuts were broadly in line with expectations and there was a relatively favourable market reaction with relief that the deficit is being tackled, especially as the latest deficit data registered a GBP15.7bn borrowing requirement for September which was the highest figure on record for that month.

Sterling confidence could falter if there is any sign of a renewed deterioration in conditions over the next few weeks as spending reductions would be seen less favourably.

Sterling tested support levels beyond 0.88 against the Euro and was unable to hold above 1.5850 against the dollar.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Swiss franc

The Euro has maintained a firmer tone against the Swiss franc over the past 24 hours and strengthened to a high near 1.35 before stalling. The dollar was unable to hold above 0.97 against the Swiss currency, but found support near 0.96 as cross-related moves cushioned moves.

The relatively hawkish comments from ECB member Stark and an improvement in risk appetite dampened immediate demand for the Swiss franc on defensive grounds, but markets will remain very uneasy over the medium-term Euro-zone outlook which will tend to limit selling pressure on the franc.

Australian dollar

The Australian dollar found support below 0.97 against the US currency on Wednesday and then rallied firmly back to above the 0.9850 level. There was renewed weakness in the US currency which allowed the Australian dollar to rally and there was renewed interest in commodity-related currencies, especially as risk appetite looked to recover.

Volatility will remain an important risk in the near term with the currency continuing to gain underlying support from expectations of further quantitative easing led by the US Federal Reserve.