EUR/USD

The dollar was subjected to renewed selling pressure during the European session on Tuesday and, although it managed to resist further substantial losses, it remained generally on the defensive.

There was a warning from a Chinese economic institute that China needed to be wary over holding too many dollar-denominated assets which triggered initial selling pressure on the dollar. The comments were later removed from the website, but underlying confidence remained fragile.

Fed Chairman Bernanke stated that the economy remains in need of a boost given that growth remains below potential, but he also commented that there was no need for further stimulus. The remarks continued to suggest that the Fed will resist any further quantitative easing, but will also keep interest rates at very low levels over the next few months which continued to dampen the dollar on yield grounds.

Risk appetite was generally firmer during the day which also dampened immediate demand for the US currency, although there was still a mood of caution.

There was market optimism that the Euro-zone leaders would be able to agree a fresh rescue plan for Greece with expectations of a EUR80-100bn support package over three years. There were still doubts over the underlying debt profile and confidence dipped again following comments from the German Finance Ministry that bondholders would have to take a substantial share of losses. Without a workable solution, fear could flare-up again very quickly on fears over financial-system instability.

There were further expectations that the ECB would adopt tough rhetoric at Thursday’s council meeting and indicate that a further interest rate increase was likely in July. These expectations will tend to maintain short-term Euro demand, but there was tough resistance in the 1.47 area and the Euro edged weaker in Asia on Wednesday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar continued to test support in the 80 region against the yen during Tuesday and briefly dipped below this level for the second successive day. The dollar was again undermined by a lack of yield support, especially after Fed Chairman Bernanke suggested that monetary policy would remain very accommodative to support the US economy.

There was further speculation over G7 intervention which triggered caution over yen buying with the Finance Ministry again stating that it was watching the situation very closely. There was also a general improvement in risk appetite which helped curb immediate yen buying on safe-haven grounds.

There was renewed unease over the Asian economic growth outlook on Wednesday which underpinned the yen and the dollar was trapped close to the 80 level.

Sterling

Sterling found support below 1.6350 against the dollar on Tuesday and rallied to a high above 1.6450 before consolidating just below this level. Dollar weakness was the main catalyst for Sterling gains, although activity was stifled by caution ahead of the European interest rate decisions on Thursday. Sterling remained under pressure against the Euro with a further test of support near 0.8950 on expectations that the ECB will be more willing to raise interest rates.

There were further expectations of weakening demand as consumer spending remains under pressure while the latest Halifax house-price index recorded a 0.1% monthly increase for May. The data overall maintained expectations that the Bank of England would be extremely slow to increase interest rates with no increase expected at this week’s MPC meeting.

Sterling will gain strongly if there is a hike in interest rates, although support could prove to be very fragile given expectations that higher borrowing costs would further damage the economy.

Swiss franc

The dollar dipped to record lows near 0.8325 against the franc on Tuesday, but it then rallied back to the 0.8370 area as bargain hunting was compounded by a weaker franc tone on the crosses with the Euro rallying to above 1.23.

Immediate demand for the franc was dampened by a general improvement in risk appetite and hopes that Euro-zone economic tensions could be eased by a fresh rescue package for Greece. There will still be a reluctance to sell the Swiss currency aggressively given the underlying tensions, especially as there is no actual package in place yet.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Australian dollar

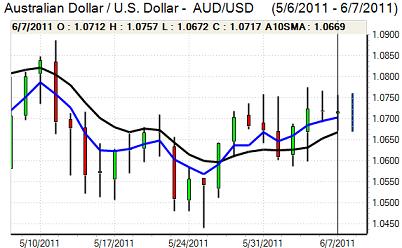

The Australian dollar found support below the 1.07 level against the US dollar during Tuesday, but rallies were limited to the 1.0735 area as the Australian currency under-performed on the crosses.

There was a further negative impact from the slightly more dovish than expected Reserve Bank statement and a firmer reading for home loans also provided only limited support.

The Australian currency was unable to gain support from a general improvement in risk appetite and Asian growth concerns were again a focus on Wednesday which pushed the Australian dollar back to below the 1.07 level.