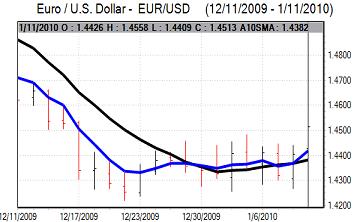

EUR/USD

The dollar weakened further in Asian trading on Monday with lows beyond 1.4520 against the dollar as there were further generally dovish comments on interest rates from Regional Fed President Bullard. Risk appetite was also generally firmer which curbed any defensive demand for the US currency.

Following the weaker than expected US payroll report on Friday, there will be a downgrading of market expectations surrounding higher US interest rates during the first half of 2010 and this will tend to undermine dollar support. Comments from Fed officials will remain under close scrutiny over the next few days with a particular focus on any remarks from Chairman Bernanke.

Bond yields over equivalent European bonds have still moved in the dollar’s favour over the past few weeks and this shift should help lessen selling pressure on the US currency.

There will also be persistent fears over structural weaknesses within the Euro-zone which will undermine the Euro, especially with some speculation that the Greek budget deficit could be even wider than expected for 2010. The EU Commission also issued a downbeat assessment of Greece’s debt situation and confidence in the weaker Euro-zone members will remain very fragile.

There will be some caution ahead of Thursday’s ECB policy meeting which will discourage aggressive positioning in the Euro. The dollar found some support close to 1.4550 against the Euro, but was unable to regain much ground.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

Overall confidence in the Japanese currency will still be weak amid further speculation that the government will be more pro-active in pushing for a weaker yen following the appointment of Kan as Finance Minster.

There is also likely to be some further speculation over a flow of funds into commodity currencies which will tend to sap yen support. The dollar was able to hold above 92 against the yen on Monday with the Japanese currency losing ground on the crosses.

The dollar edged weaker to the 91.85 region later in US trading with markets looking to trigger stop-loss levels below the 92 level.

Sterling

Sterling moves were influenced strongly by wider dollar moves during Monday with the UK currency able to resist a fresh challenge of support levels below 1.60 against the dollar. Sterling, in turn, was unable to push above the 1.62 and drifted weaker later in the US session as the Euro attempted to hold above the 0.90 level.

There were no domestic data releases to influence Sterling on Monday. The trade data, due for release on Tuesday, is unlikely to have a substantial impact on the UK currency unless there is a sharp deterioration in the monthly account.

Underlying confidence in the UK economy will remain weak as debt fears and credit-rating speculation continued to swirl around the markets.

Swiss franc

The dollar was on the defensive against the Swiss franc for most of Monday and weakened to lows near 1.0130 against the Swiss currency before consolidating around 1.0150.

National Bank chairman Hildebrand stated that the bank would continue to resist excessive Swiss currency appreciation, but there will be some speculation that the rhetoric was less aggressive than expected with the bank less willing to make aggressive moves.

The central bank head also commented that the bank has begun to withdraw excessive liquidity and this will tend to provide some degree of support for the Swiss currency.

The Euro found support below 1.4750 against the franc after Hildebrand’s comments, but was unable to make significant headway.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

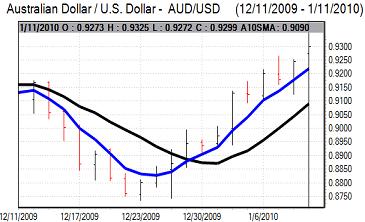

Australian dollar

The Australian dollar maintained a strong tone on Monday and pushed to a high of 0.9325 as the US currency remained generally weaker. Stronger than expected export data from China triggered additional demand for the Australian currency on hopes for stronger growth in the regional and global economy.

A lack of confidence in other currencies and positive yield spreads will continue to underpin the Australian dollar with strong near-term sentiment and this will tend to limit any selling pressure on the currency with consolidation above 0.93 later in the US session.