Over the last 10 years, shares of Cisco Systems (CSCO) are down over 60%. But that’s not because the company has been eroding shareholder value. Cisco earned $1.33 per diluted share in 2010, whereas it earned 36 cents per share in the year 2000. Yet the stock fell over this 10-year period because it had a P/E of 140 back then; today, Cisco has a P/E (adjusted for its net cash position) of just 10.

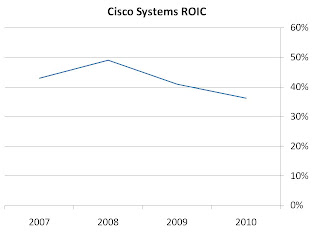

Companies with P/E ratios in the single digits or low double-digits usually generate low returns on capital as a result of having no competitive advantage. This is not the case with Cisco, as borne out by the following return* on invested capital (ROIC) data over the last few years:

Before panicking at the apparent downtrend, consider that 1) the absolute numbers are still high, and 2) numbers will be weaker during a recession. These high returns do suggest that Cisco has a moat. Further analysis of the company’s core products reveals that Cisco dominates several product lines, in some cases delivering market share numbers north of 70% and even 80%. These kinds of numbers will help Cisco maintain and grow its moat, as it is able to spread R&D spend over a much larger number of units than are its competitors.

Sometimes, companies will also trade at low P/E’s because a company’s industry is in secular decline (e.g. the newspaper industry). This, too, is hardly the case for Cisco. In fact, it may be just the opposite. Networking needs continue to grow worldwide as populations continue to seek higher and higher bandwidth connectivity for a multitude of devices. Cisco is at the forefront of the network hardware architectures required to make this happen.

Finally, companies also trade at low P/E’s because of negative short-term sentiment. That appears to be what’s happening here. The company’s latest quarterly guidance was below estimates, as Cisco expects just 3-5% year-over-year revenue growth next quarter due in part to government budget cuts, as state and local governments look to bring their fiscal houses in order. This caused the stock to fall some 20% over the last two weeks. But annual revenue growth is still expected to come in between 9 and 12%, suggesting the business is still sound, growing and undeserving of such a low P/E.

Cisco’s board agrees, as it has now authorized the company to buy back almost 14% of its outstanding shares. A look at the company’s cash flow statements shows that Cisco has been quite willing to return cash to shareholders in this manner, and recent management comments suggest this will continue:

“If you look at what we do, we always purchase the stock during periods when we see it sliding a little bit.”

When a company with a sustainable and proven competitive advantage trades at a low P/E, opportunity knocks. Investors with an eye for the long term are likely to do well going long in such situations.

Disclosure: Author has a long position in shares of CSCO

* As there are many formulas to choose from when calculating ROIC, it should be noted that here, ROIC is calculated as OpIncome(1-tax)/(Debt+Equity-Cash)