The dollar index has probed above the 80.00 level today as weak corporate earnings, continued uncertainty surrounding the euro zone debt crisis and persistent global growth concerns prompt renewed risk aversion. The 80 level in the DX seems hauntingly familiar. In fact, it pretty much defines the midpoint (actually 80.20) of the range that has dominated since the index initially fell below 80.00 back in September of 2007. Since then, the dollar has passed back and forth across this level many times.

Coming off its 2001 peak at 121.00, the DX actually first approached 80.00 in December of 2004, when it established a temporary bottom at 80.39. Arguably the dollar (as measured by the dollar index) is effectively “unchanged” over the past seven years.

Noting how the financial press is very quick to attribute price fluctuations in gold to the rise and fall of the dollar, my colleague Jonathan Kosares posed the following question in our October newsletter: “If the dollar index is so important to predicting and explaining the value of gold, then how does one explain that seven years after hitting the low of 80.77 (close), the dollar index is still trading in the same range – just above 80 today – yet gold has quadrupled?”

Falling back on the perceived inverse correlation between the dollar and gold is easy to do. As I write about the gold market every day, I have done it many times myself. If you look at this daily chart of the dollar index, with the gold price overlayed, you can see why:

However, it’s always worthwhile to take a step back and re-familiarize ones-self with the longer-term perspective. The monthly chart drives home Jonathan’s point pretty effectively; gold’s secular bull market commenced in the midst of a dramatic rally in the dollar index from the late-90s through the early-00s.

After the dollar index peaked, it lost a third of its value over the course of about three-years. The corresponding correction in gold was less than 20%, at which point the yellow metal rebounded, while the dollar resumed its fall. From its high in 2001 at 121.00 to its low in 2008 at 70.79, the DX plunged 41.5%.

During the worst days of the financial crisis, we saw the DX and gold become correlated as investors delevered and sought safety both in gold and the greenback. While gold went on to establish a series of new all-time highs, ultimately reaching $1920.74 a little more than a year ago, the dollar index recovered less than a third of the losses realized in the preceding years before coming under renewed pressure.

During the more recent consolidative phase the two markets have been inversely correlated. Nonetheless, Kosares goes on to suggest that “the long accepted inverse correlation between the dollar index and the gold market is flawed and needs to be abandoned. Not just because it fails to explain the last seven years of gold’s performance, but it stands to only become more irrelevant, and even potentially misleading, moving forward.”

What’s important to remember, is that the DX is a measure of the value of the dollar relative to other major currencies. The zero interest rate policies, competitive currency devaluations and interventions of the last several years have forced down the values of many currencies simultaneously. In that context, it’s not surprising that the dollar is at best treading water in a draining pool. “Race to the bottom” is a phrase bandied about by many that have made note of the escalating currency wars.

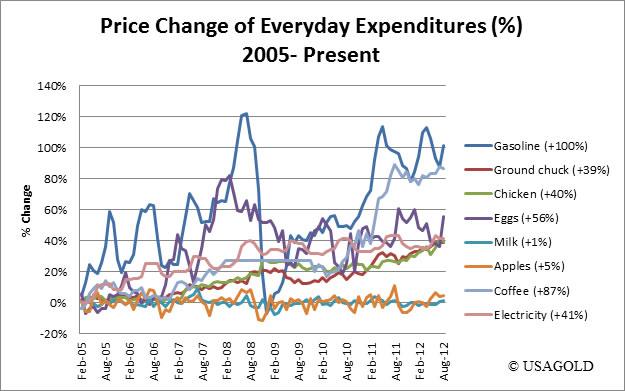

What’s truly significant from a consumer’s perspective is that the purchasing power of the dollar has eroded significantly against the things most families spend their money on, seemingly in conflict with the perceived stability of the dollar.

On average, the items charted above are 45% more expensive than they were in January 2005, with gasoline costing double. I would expect the FOMC to reiterate today that “inflation has been subdued,” although anyone who goes to the grocery store or drives would likely beg to differ.

The takeaway here is: Don’t be deceived by the relative “stability” of the dollar index, nor the notion that inflation is subdued. The gold market is trying to tell us something; in fact, many things. And one of them is that there are indeed price risks percolating just below the surface of this subdued economy. Gold is a critical component in a well diversified portfolio, which can truly shine in an inflationary environment.

= = =

Read more trading ideas here.

[Editor’s note: read more in Grant’s October newsletter. ]