Seasonally, (since 1970) November has been the third best month of the year for gold. Despite that track record, I wouldn’t get too bullish yet about Friday’s (full-moon inspired) $27.30 rally.

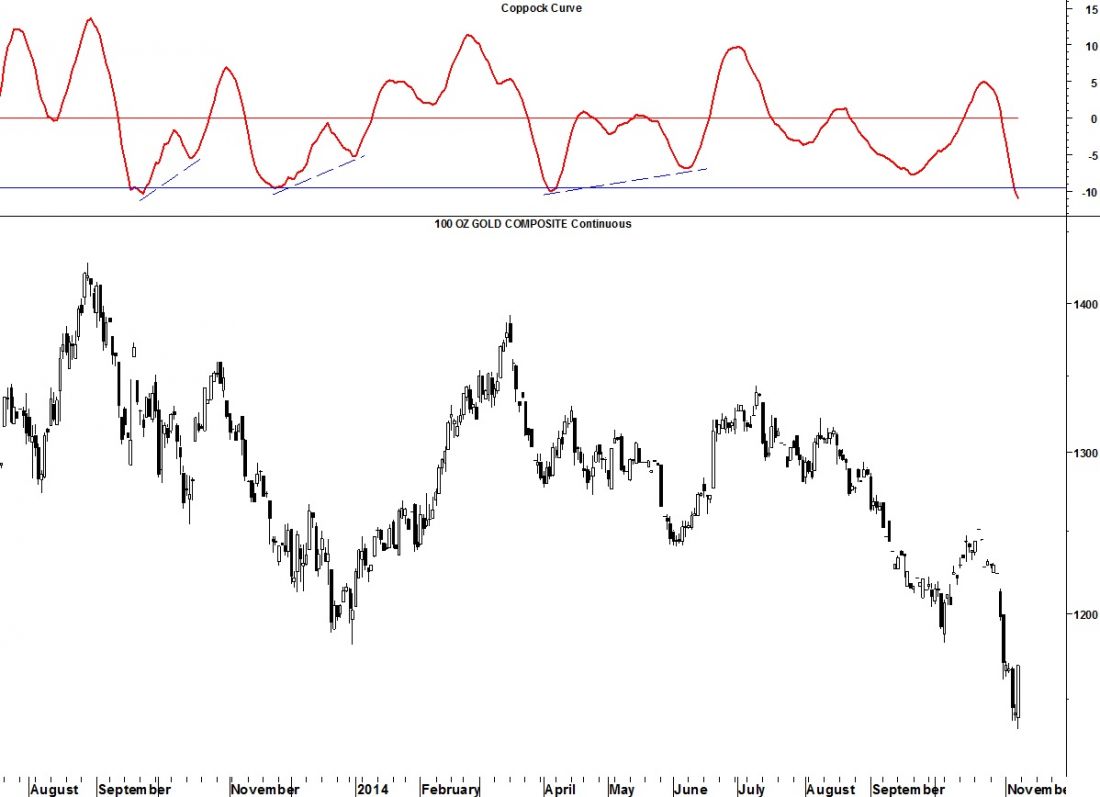

Friday’s intra-day low at 1,132.90 was probably close enough to my price target of 1,126 to call the price decline over for now, but gold’s Coppock Curve has reached a low which has forecast lows in gold for the last year, but not without a positive divergence forming first.

Another reason to expect some base-building before a tradable rally begins is that my bandwidth indicator confirmed last week’s decline and halted its advance with Friday’s rally. Any further rally in gold this week will likely be followed by a test of Thursday’s low.

Short-term trading cycles point to a low near late Nov/early Dec followed by a rally into a February high at the soonest.