Yesterday

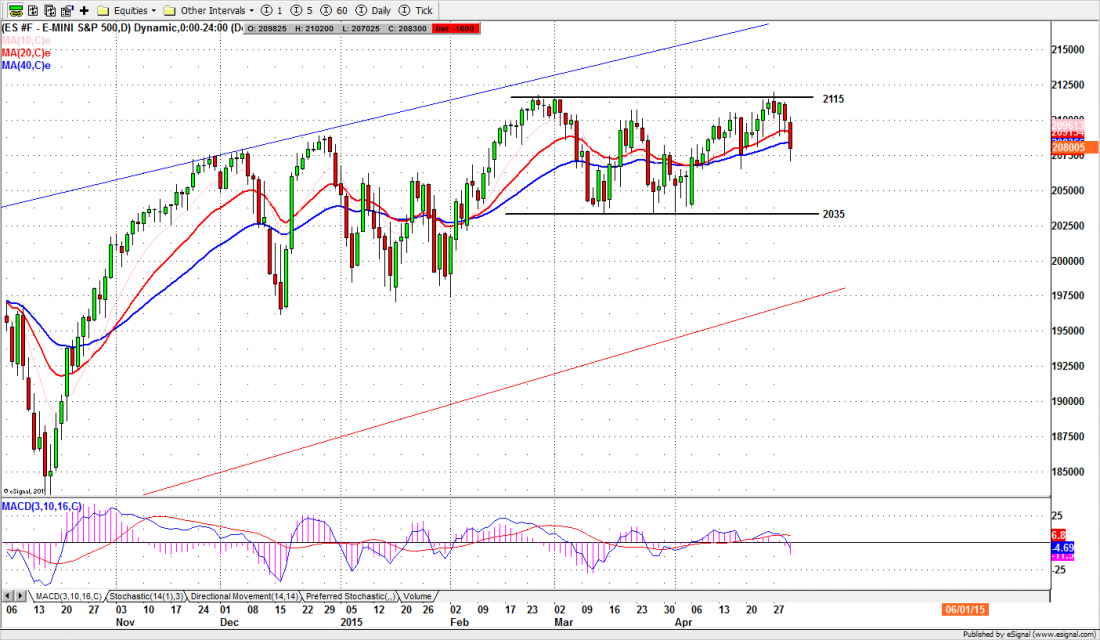

The S&P500 mini futures (ES) had the kind of day on Thursday that makes long-term investors start trying to figure out if this time it really is the top. The June contract (ESM5) opened down, went down all day (breaking below 2090-2088, last year’s high and a significant support area) and breaking the short-term momentum lines, the 20/40-day moving averages, and closing below them.

Only a massive effort by the Plunge Protection Team – they tossed a third of the day’s volume into the last hour at the bottom – managed to drag it off the low at 2070. But the contract still closed at 2079, fully 20 points below the previous close.

More important, it confirmed the market is trying to establish a double top pattern, by withdrawing from the breakout point (see the daily chart). The failure to breakout from this long congestion pattern will have investors looking over their shoulders as we start to move into the summer doldrums. If it persists, sell in May might happen early.

Today

Today we need to see some kind of follow-through on the downside move. We will be looking for a move below 2064.50 to confirm that the double top pattern is under construction. If we see it, we’ll be looking for a further decline.

Conversely a move above 2096.50 level and close above it will indicate that the bulls still have some energy left. However if what happens is just a bounce to test the breakdown level, we will be watching for an opportunity for a short side entry. For the immediate future our major focus should be on finding swing short positions.

At the top of this pattern, 2121.75-2123.50 is a major short-term resistance zone. As long as the ES stays below that level we are expecting a continuing slow grind downward.

Major support levels for Friday: 2073-71, 2062.50-64.50, 2055-56.50;

the major resistance levels: 2102-05.50, 2123.25-21.50, 2129.50-32.50.

###

Naturus.com publishes a free weekly analysis of US equity indices. You can get on the mailing list at this link.

Related Education: