This trade setup is merely a random sample of the day’s trades generated by COT Signals. To track our work their and receive all of our nightly trading recommendations.

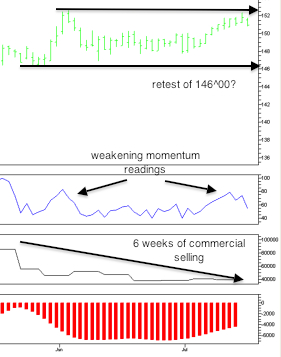

Commercial traders have been placing heavier bets on a rise in yield for long dated Treasuries. This is most obvious in the 30yr Treasury Bond futures. Commercial traders have cut their position by more than half in the last six weeks. This move also fits in with the action in the interest rate sector we discussed in mid June in, “Fear and Inflation.”

Briefly, we discussed the very light buying of Treasury futures during May’s equity sell off. Their buying was substantially less than would be expected during a flight to safety rally. Finally, we pointed out a piece by Crestmont Research on interest rate volatility and using their analysis came up with a price envelope for December Bond futures of 154^20 on the high side and 140^06 on the low side. Extrapolating this to the September contract we are currently trading and we get 153^17 high to 138^30 low. We will be selling 30yr Treasury Bond futures and placing our protective stop above the swing high at 152^10.

Sign up for COT Signals.

ANDREW WALDOCK

866-990-0777