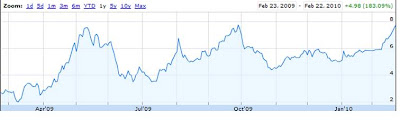

Consider the following 1-year stock chart:

Notice the extreme volatility in this company’s stock. In the last year, the company has quadrupled in value, shed 50% of its value, doubled again in price, almost halved itself again, and has recently almost doubled yet again.

What kind of company would see so much volatility? One might expect this to be a highly speculative company. Perhaps it is a troubled bank, with high leverage and an uncertain future. Or, perhaps it is a commodity company that sells a product with extreme price movements.

Surprisingly, however, the above stock chart belongs to a company with neither of those characteristics. In fact, the company has cash far in excess of its debt, and has traded for less than its cash value over a significant part of the period depicted above. The company is LCA-Vision (LCAV).

LCA-Vision has already shown up on the Value In Action page because of its huge price run-up in September of 2009. In the months following, it subsequently returned most of those gains, and therefore once again offered investors the chance to buy the company at what appeared to be a discount. As a result, it has resided on the Stock Ideas page since late last year.

As seen from the above chart, however, the stock has once again shown tremendous gains in a very short amount of time, resulting in strong gains for investors who took advantage of the highly volatile price. Fundamentally, however, the business has not changed much in the last year. The company continues to make cost cuts in an attempt to remain cash flow positive until revenue growth returns, while maintaining its strong competitive position.

So while the business has been relatively stable over the last year, the stock price has been anything but, allowing the value investor to buy low and sell high. While stock price volatility is considered risky in the mainstream financial industry, it is the friend of the value investor.

Disclosure: None