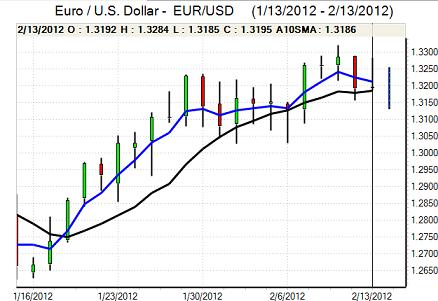

EUR/USD

The Euro rallied ahead of the European open on Monday, boosted by the Greek parliament’s decision to approve austerity measures demanded as part of the EUR130bn loan package.

The decision should pave the way for approval at the Eurogroup meeting on Wednesday which in theory would be enough to ensure that Greece doesn’t default. The Euro was unable to break above the 1.33 area against the US currency and retreated steadily during the day.

There were still very important doubts surrounding the Greek package with particular concerns surrounding medium-term viability. Although parliament approved the package of measures, there was a high degree of opposition to the plans and there is a high degree of popular resentment surrounding the measures. There was also speculation that only part of the package would be approved by Euro countries.

The German stance remained an important aspect and there were further tough remarks from Finance Minister Schauble. The underlying impression given is still that Germany would prefer to force Greece out of the Euro and look to limit the contagion risk. The remarks were fuelled by promises that Greece would stay part of Europe even if it did leave the Euro-zone.

There were no significant US data releases during the day and President Obama’s budget presentation did not have a major impact. The US currency attempted to gain some support on yield grounds, although the impact was limited. The Euro dipped back to the 1.32 area during the day with further expectations that the currency would weaken in the medium term. The currency was undermined further by Moody’s decision to downgrade several European sovereign ratings with Spain cut by two notches and the Euro weakened to lows below 1.3150 against the dollar in Asia on Tuesday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was capped in the 77.80 area against the yen during Monday and there was a retreat to test support below 77.50 before a rally back to the 77.55 area. The Euro was also unable to sustain a move above 103 against the Japanese currency.

The Japanese GDP data was weaker than expected with a 0.6% decline for the fourth quarter compared with expectations of a 0.3% decline. The data increased pressure for the Bank of Japan and Finance Ministry to combat yen strength.

At the latest policy meeting the central bank left interest rates on hold at 0.0-0.1%, but it did announce a further increase in quantitative easing. The pool of funds to buy long-term government bonds was increased by a further JPY10trn to JPY30trn with a total quantitative easing of JPY65trn. The central bank also defined 1.0% as its near-term inflation goal. In response, the yen weakened to near 78 against the dollar.

Sterling

Sterling tested resistance above 1.58 against the dollar on Monday as the US currency was subjected to some selling pressure, but it was unable to sustain the gains and dipped back to test support below 1.58 during the day.

Although the CBI reduced its GDP growth forecasts for 2012 with a reduction to 0.9% from 1.2% previously, there was relief that the organisation was expecting the UK to avoid a double-dip recession which provided some degree of Sterling support.

In contrast, the latest Bank of England report confirmed that commercial bank lending was again below target levels which will maintain unease over the economic outlook. The UK credit rating outlook was also put on negative watch by Moody’s due to financial strains emanating from the Euro-zone crisis and this pushed Sterling lower with a retreat to the 1.57 area against the dollar, although it held steady against the Euro.

Swiss franc

The dollar again found support on dips to near the 0.91 area against the franc on Monday and pushed back to the 0.9150 region during the day. The Euro was unable to make a move back above the 1.21 level against the Swiss currency and consolidated just below this level in cautious trade.

The latest Swiss produced prices data recorded a decline of 2.4% in the year to January with prices unchanged for the month and the National Bank will remain on alert over deflationary pressure. The Bank of Japan move to expand quantitative easing could lead to further defensive flows into the Swiss currency.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

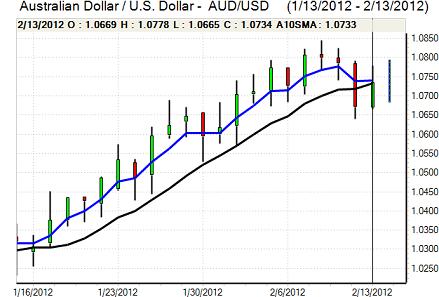

Australian dollar

The Australian dollar found support above 1.0650 against the US dollar and pushed to a high towards 1.0780 before drifting weaker again as wider US moves tended to dominate the currency.

The latest home-loans data was stronger than expected with a 2.3% gain for January which provided some support to The Australian currency while business confidence was little changed in the latest NAB survey.

There were concerns over the Asian economic outlook which had some impact in curbing aggressive demand for the currency as longer-term players again took advantage of gains to sell the Australian dollar as it re-tested support below 1.07.