By: Brandon Rowley

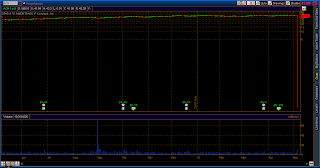

If we didn’t realize it before, now we do: computerized markets are FAST! Add together an overbought market ripe for a pull-in with contagion fears in Europe and a tape 70% dominated by algorithms and you have a recipe for a rapid decline. What many are calling a “fat finger” trade in shares of Procter & Gamble (PG) helped to completely collapse the market this afternoon. PG cascaded 37% in just a few minutes before rocketing back up to close down just over 2%. Rumors are that a trader at Citigroup entered his trade for a “billion” shares to sell rather than a “million” in shares of PG. Yet, Citigroup says there is no evidence of that occurring. Either way, the Dow was in a complete free fall the likes of which I haven’t seen since October 2008.

Major fears in Europe have the euro in an incredibly steep decline. The future of the Eurozone’s monetary union is in question. Monetary unions have not worked in the past and this being the first real test of the euro, it is clear many are betting it will not hold up.

Yet, today’s decline was far more than worries about the eurozone. It seems to me that some firm on the Street completely lost their shirts today in PG and caused a complete market crash. If PG doesn’t shock you, take a look at ACN which hit exactly one penny before rebounding over $40 per share. Wild, wild stuff!