The Golden Sunrise

The essential morning read for investors

Golden Sunrise is the Golden Surveyor’s broad-based market and world view.

Written daily 4am-7am by markets information specialist GS John

Today’s Golden Sunrise

Tuesday, May 18, 2010

Hours of daily research consolidated for you

Dr. Copper Hospitalized

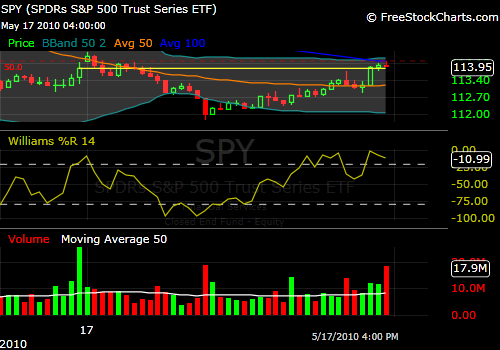

Yesterday was an amazing day…The SPY..the yellow bar across the top is the starting point for the day with which to judge the day’s movement. At noon, the S&P was down 17.9 and finished up 1.2, the Dow was down 156 and finished up 56, and the NASDAQ finished the day +7.3 but was down 32.2 as you wolfed down your BigMacs during lunch.

News influences showed the TIC report demonstrated net foreign investment into the United States of $140.5 billion in March, including renewed buying by both China ($18.7B) and Japan ($16.4) of US government securities. Even the Russians came back into the game although obliquely as the reduced the Euro as a percentage of reserves.

Foreign funds also flowed into corporate debt in the US to the tune of $16 Billion, a big increase from the $12B in February.

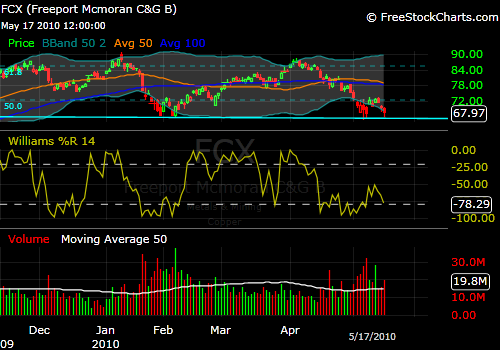

The declines in China has created a fear that there will never be another house, building, bridge, or any other manufactured item that will require the use of copper…which is the metal most pundits generally describe as the being the key prospective growth metric.

It has been a tough couple of weeks and yesterday was a smash.

The Weekly chart for JJC, the copper etf. Horrid momentum, volume.

Yesterday-pretty close to the Feb 5 bottom-bounce or failure from here might be an important message.

Gold is getting hammered as well-this morning’s crush adding to yesterday’s beating. The big Kahuna in this combo space is Freeport McMoran..chart below. The blue base line has been a rebound point.

Momentum still heading down and the negative volume is expanding.

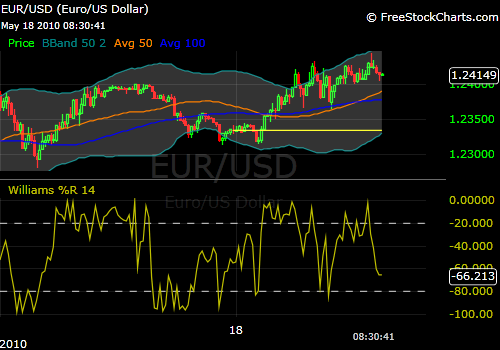

Everything has been revolving around the Euro…after a couple of days of hearing about its’ collapse and failure and heading to parity..it is heading up this morning. Yellow base line is from midnight on

It is up into the 124s and that already seems like a high level. A couple of days of 123s and a multi-month low of 122.35 gets cemented in the consciousness very quickly.

This morning copper is trading back to $3 up about 2.32%.

So all is right in Euroland and we want to dump gold to buy Euros.

The top trendline (in blue) is drawn from the December 2nd high. The lower line is across some visible support points. This point will be another source point of valuable information. This line could well get tested in the next day or two.

I am gearing up buypoints- Yamana and Aurizon (two stocks I have done very well with) have big copper components to their gold production so are two candidates in the copper/gold space. GDX and GDXJ are good etfs that will find bases and buypoints.

JohnR

Goldensurveyor.com