I have been saying it for years, follow the volume.

Nobody will pick up the phone and call you saying a big bank or hedge fund are buying millions of shares of XYZ stock, yet if you look closely at stock and option volume that is just what is being said.

FOLLOW THE MONEY

I have some screens that identify the big option volume moves – we’re talking huge outliers that tell me something is brewing. Now, these don’t always work out exactly as planned but suffice to say if you follow the money the success rate is pretty high, if the timing is correct. To adjust for that difference I will often take an extra month or go in one strike as my preferred play. But do you believe as I do that big volume is a clue into the next big move?

VOLUME IS KEY

Now, much of my analysis is about technicals and charts, but I have to see where the money is flowing. Volume is the only way to know.

THE TRADE

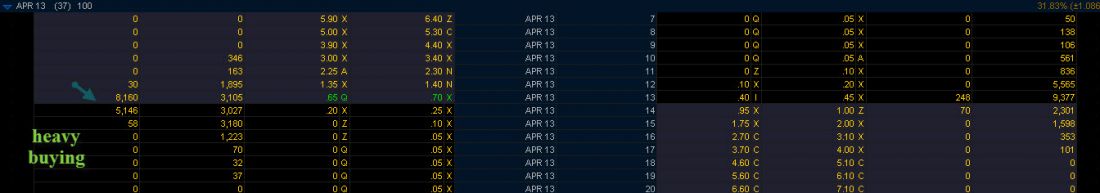

Let’s take a look at Goodyear Tire (GT) from Mar 13. As you can see from Figure 1 below a slew of Apr calls were bought aggressively (yes, bought!) that far exceeded the open interest.

Simply put the demand was far stronger than the supply. The Apr 13 is at the money while the 14 strike out of the money with the stock trading closing at 13.42. So, the interest was right here, but

I went for the Apr 12 call for a bit more intrinsic value and protection at 1.40 (nearly a 1-1 move for the option with the stock now, or delta of .84). I’m looking for a move north of 14, likely 15 – which is probably what the big buyer of the 13 and 14 calls is looking for, too. At 15 bucks that will be nearly a double for my call play. I’ll just jump on his coattails and hang on tight!

Position: Long Apr 12 GT call at 1.40

= = =

[Editor’s note: Learn more about how volume can help you in your trading here.]