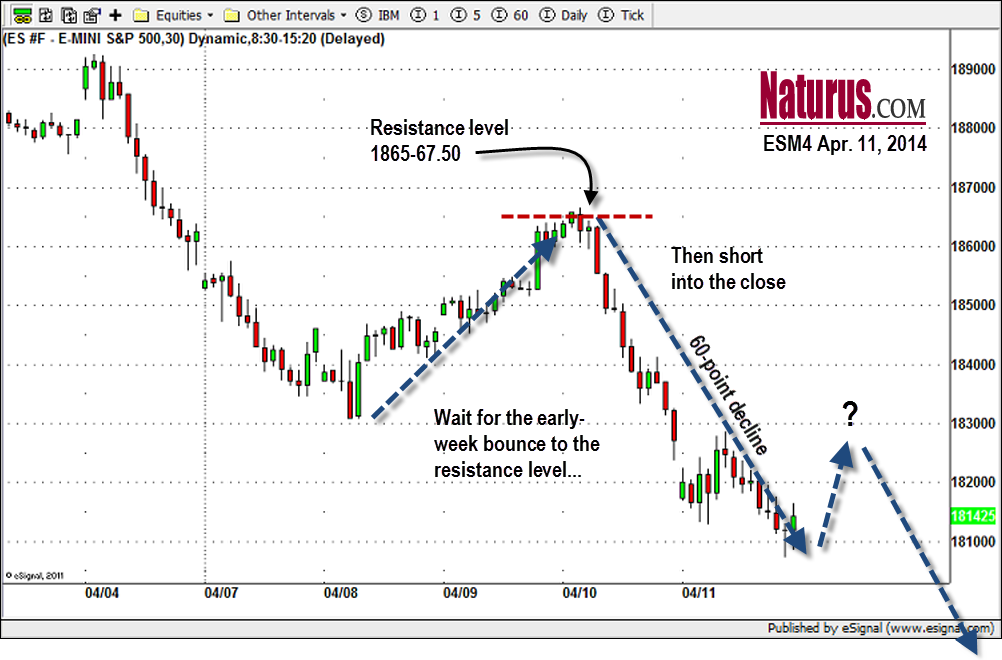

Last week we identified the key level in the the S&P 500 e-mini futures contract as 1865. If the market could not move above it, we said last Monday, a decline to at least 1830 was all but certain, with a strong possibility of more to come.

The e-mini futures contract (ES) tried to move past 1865 Wednesday and Thursday (April 9 and 10) failed, and dropped 60 points in two days. (See chart). We were all over it..

This week we think there could be be a little short-term bounce followed by a sell-off into the Easter holiday. It is a short week, the market typically likes Easter, and the selling is probably overdone at this stage.

The 1800-05 level needs to hold the ES up for a pre-holiday bounce. If it holds we could bounce up near last Friday’s high area 1828.75-1832 or under the broken support zone 1846.50-1850. Those are short entries for us.

But if Russia invades the Ukraine, don’t expect a bounce. That could drive the ES below 1795-92, and incite panic selling down toward 1787-85 or lower to 1775-70.

Chart: S&P500 E-mini futures

= = =

Learn more about Naturus, a subscription service for futures traders here. Register for a free weekly preview here.