A week ago we were taking about the S&P futures climbing a “wall of worry” that could be setting up a bull trap – a fake break-out that might reverse and catch the buyers leaning the wrong way. The market was moving steadily up—but there were some intra-day indicators that made us sweat.

THE KEY LEVELS

We identified a couple of checkpoints that would confirm the rally for us. One was an unfilled gap at the 1623 level; the second was a resistance level around 1648. Now the price has moved past both, the rally is well-established, and we see more room for the upside.

Last Tuesday we wrote:

Our fundamental stance is bullish. If we see the price move above 1648 – 49 we will regard that as confirmation that the downside correction is finished and the bulls are back in control. We will then be looking for the price to return to the previous high at 1685.75 – forming a double top – and perhaps move beyond that level to make a new high.

That’s pretty much what happened and what we expected to happen.

The price moved decisively through our checkpoint and closed up on Monday at 1677.50 – the 10th day in a row without a down close. The last time the futures closed down for the day was 77 points in the past.

GASPING FOR AIR

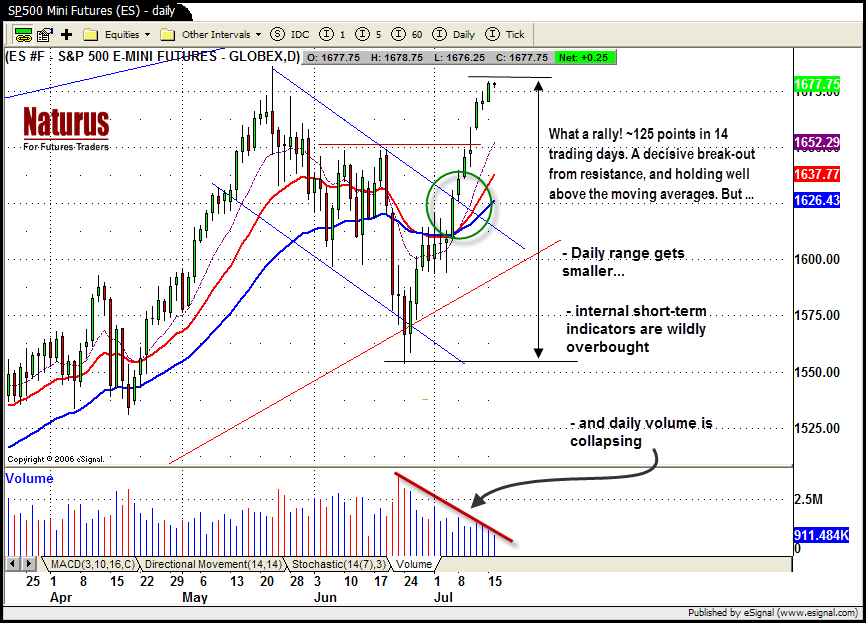

But the rally still looks like it is gasping for air. The range is narrow – Monday was the smallest range for seven days – the volume is very light, and while the closes are green, they are moving up by smaller and smaller amounts.

The daily chart for the S&P futures demonstrates what we mean.

So we’re still worried … but still bullish. We think the futures will get back to May’s high around 1685, and may move well beyond it. Back in May we identified 1735 as a likely top if we make a new high. We still like that target.

WHAT HAPPENS NEXT?

In the short-term the futures are wildly overbought. As the price gets closer to 1685.75, the May high, the lucky bulls who have been riding this rally up will start to think about taking some of their profits out of the market. Since June 24, long-side futures traders are up about $6,000 per contract. They will want to move some of that out of harm’s way.

So some type of pull-back is likely. But we think the bulls are still calling the shots, and we are looking for any substantial retreat as a long-side entry level. In particular, if we see a retracement to the broken resistance at 1645-50 we will be buyers.

= = =

Naturus is the web-name of Polly Dampier, who is the brains behind Naturus.com, where she gives active traders real-time market guidance. For more information on her index futures trades, visit www.naturus.com