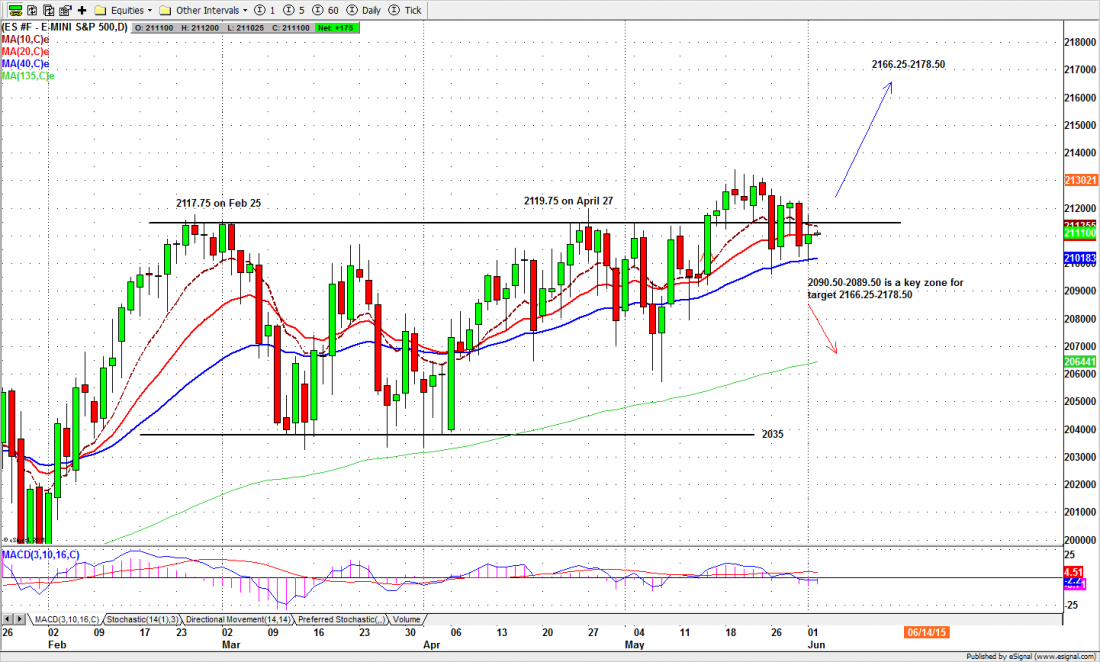

The S&P 500 mini futures (ES) closed at 2109.00 on Monday, up three points from the previous close, in a continuation of the consolidation movement the ES has been following for almost two weeks.

If you liked Friday’s trading, you’ll like what happened yesterday: nothing much. The futures made a slightly lower high, a slightly lower low, and a slightly higher close.

For intraday traders like us, there was lots of tradable action: the market dumped about 15 points right after the open, reversed and rallied 17 points by mid-afternoon, then gave back about 50% of the gain for the close.

Down, up, down. Lots of good trading opportunities, thank you very much. But in terms of moving the market to a new place, it just didn’t happen. After a brief excursion outside the intermediate term resistance that has been constraining the price since March, the ES is now right back in the same old familiar territory. Been there. Done that.

What’s Next

The thing about extended consolidation movements like the one shown in the chart is that everybody knows they can bust out quickly. Once the price has broken the resistance once, it can do it again. Anytime.

But figuring out when this is likely to happen, or even which direction the next movement will take, is largely a matter of guesswork.

One possibility is that the ES stays inside the 2119.50 to 2100 range again today, just bouncing back and forth, killing time until June 5, the next deadline for the Greek debt debacle, and the day the US employment numbers are reported.

A second possibility is that the ES breaks to the upside. For that to happen we need a move above 2120 with strong momentum. The probable targets would be 2125-27, with an extended target at 2135-36.50. We will be shorting if it reaches that level.

A third possibility is a drop below the current support around 2091-92. The most likely catalyst would be bad news from the world beyond the Street, and the drop could be stomach-churning.

We’ll be watching our inflection points closely for the rest of the week, trying to guess which scenario will play out. But this is the summer, folks, when traders head for the shore and the market drifts like a cork in a current. We may well be back here again next week, with nothing much resolved.

Major support levels for Tuesday: 2092-89, 2081.50-79.50, 2062-59.50;

major resistance levels: 2134-36.60 and none

To receive free market insights with actionable strategies from naturus.com, click here

Chart: ESM5 Daily chart, June 1, 2015