Yesterday

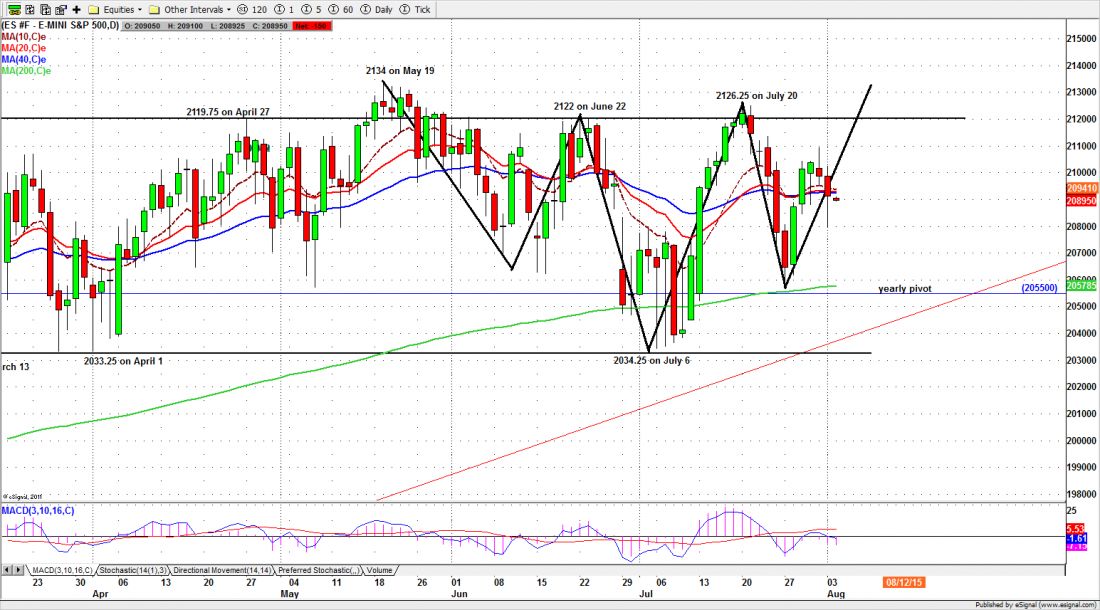

Monday the S&P500 mini-futures, the ES, continued moving down extending the weakness we saw in Friday’s closing movement. It spent most of the day in decline, and only the now customary 3:00 pm ramp-a-thon moved it off the lows and allowed it to close respectably, at 2090.50, eight points below the previous close.

It also closed below the 20/40-day moving averages. The one ray of hope for the Bulls is that the momentum buying at the lows does not seem to have diminished much.

Today

Today we may see a continued testing of yesterday’s low around the 2080-78.50 zone, especially if the ES can’t move above 2093.75 in overnight trading. But later in the session the ES could move back up to yesterday’s high area if the price breaks above 2095.50. Volatility will continue to be high and the price could have a big swing today.

On the daily chart there is a possible bullish inverted H&S pattern forming, which I just noticed. The neckline should be above July’s high at 2026.25 or could go to our major number at 2136.50. That pattern is still tentative, and for it to work the ES has to remain above yesterday’s low around 2080-78.50.

Major support levels for Tuesday: 2054-55, 2035-32, 2025-23.50, 2018.50-16.50;

major resistance levels: 2128.50-29.50, 2134.50-36.50 and none

For more detailed market analysis from Naturus.com, free of charge, follow this link