US stock futures point to a lower open Monday morning and the market is set to open right back into the 21- and 50-day moving averages that have been acting like magnets over the past week. Last week marked the beginning of Q1 earnings season, and things really start to heat up this week. During the rally over the past 2+ years, earnings have generally topped estimates and buoyed stocks, but this quarter things have gotten off to a slow start.

After 8 straight quarters of topping analyst projections for the S&P 500, profits from last week’s 11 reports trail average forecast by 3.5%, according to Bloomberg data. In fact the percentage of companies beating forecasts has fallen for three consecutive quarters. The banks have remained the true dogs on the earnings front after weak reports from JP Morgan Chase & Co. (JPM) and Bank of America Corp. (BAC). Citigroup Inc. (C) is next on tap today to see if it can provide a boost to the sector (Update: Citi beat narrowly on earnings but missed on estimates, similar to the JPM report).

For more market and stock commentary, watch the T3Live.com Morning Call with Scott Redler (below).

With the market set to open lower, its time to survey the scene to see what is still buyable. Tech has a variety of set-ups that could move well if the market gets a lift. Perhaps the most enticing chart right now belongs to Netflix, Inc. (NFLX). The stock has rebounded back to highs after selling off sharply earlier this week, but is now in a mini consolidation just below highs. A break above the $240 level would trigger a buy in NFLX for a move back to highs.

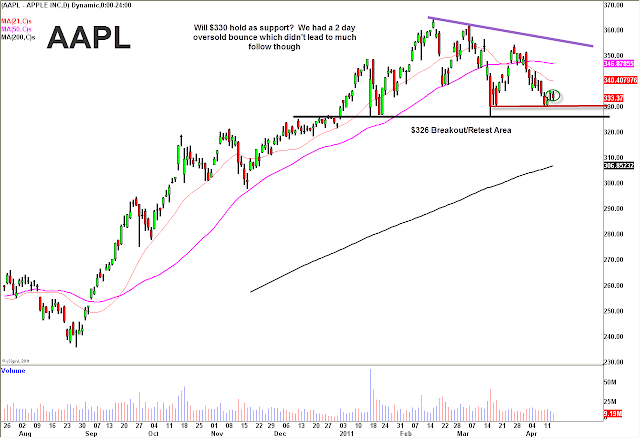

Apple Inc. (AAPL) has been tough sledding after index rebalancing, trading below support at $330 on Friday. To this point Apple has yet to trade with momentum down through support, and its hard to see such a strong company really accelerating to the downside. Most analyst price targets stand around the $450 level, and despite persistent concerns about Steve Jobs’ health, the stock should get a lift at some point. Apple is opening higher this morning, so see if it can’t drag the market higher.

The retail sector has been an area of tremendous strength this year, with familiar names like Under Armour, Inc. (UA) and Lululemon Athletica, inc. (LULU) trading very well technically. Both have remained strong over the last few weeks despite market headwinds, and are still holding up in high level bases. Look for both of these stocks to break higher on any market strength this week. There have also been some new entrants into the momentum apparel trading game. Abercrombie & Fitch Co. (ANF) has been in play since the company’s first ever analyst day boosted the stock more than 11%. The stock poked its head above an upper level flag Friday and could get more continuation. Two others to watch in the group are Tiffany & Co. (TIF) and Polo Ralph Lauren Corporation (RL), which are close to breaking out above long-term bases.

Another pocket of strength has been the casinos, which were boosted last week by news of an MGM Resorts International (MGM) joint venture in Macau. MGM, the group laggard, was the strongest, but Wynn Resorts Limited (WYNN) is the cream of the crop. WYNN broke out Friday before pulling off a bit into teh close, and is set to open slightly lower this morning. A restest and hold of the breakout area around $136 would be a good buying opportunity.

*DISCLOSURE: Scott Redler is long SPY, GLD

This material is being provided to you for educational purposes only. No information presented constitutes a recommendation by T3 LIVE or its affiliates to buy, sell or hold any security, financial product or instrument discussed therein or to engage in any specific investment strategy. The content neither is, nor should be construed as, an offer, or a solicitation of an offer, to buy, sell, or hold any securities. You are fully responsible for any investment decisions you make. Such decisions should be based solely on your evaluation of your financial circumstances, investment objectives, risk tolerance and liquidity needs. Visit the T3Live Homepage, Virtual Trading Floor, and Learn More About Us.