EUR/USD

The Euro maintained a firmer tone during the European session on Wednesday as it attempted to rally from over-sold conditions, but it was unable to break any major resistance levels and was subjected to renewed selling later in New York. There was little support from the Euro economic data as the PMI data registered a further contraction in the October final reading and there was a particularly weak outcome from Italy which maintained fears over the peripheral outlook.

French and German leaders met with Greece Prime Minister Papandreou to discuss the referendum plan. There was little attempt to disguise the anger over Greece’s decision, especially as it has plunged the Euro-zone into fresh crisis.

There were strong statements that Greece would not receive further aid until the issue of Euro membership had been resolved. The referendum is likely to be held on December 4th and, although there will be further debate over the wording, the vote is likely to be on Greece’s Euro future and not on the specific loan package. The government still needs to win a confidence vote on Friday as there will be early elections if the vote is lost.

The ECB will inevitably be a very important focus on Thursday with the ECB under intense pressure to help rescue the Euro-zone with lower interest rates and an increase in peripheral bond buying. Draghi will be very reluctant to act aggressively at his first meeting and there will be further volatility

The Fed announced that policy was on hold following the latest FOMC meeting. The message of stability allowed Bernanke to secure a unanimous vote, especially as there was some discussion on amending language putting dates on how long policy would be on hold.

The third-quarter growth was described as stronger, but the Fed still pointed to downside risks for the economy and inflation. It will, therefore, stand ready to safeguard the economic recovery with further buying of mortgage-backed securities. The dollar advanced following the Fed decision and the Euro weakened to test support below 1.37 as risk appetite deteriorated again.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support below 78 against the yen during Wednesday, but it was unable to make any significant progress during the day. Underlying yield support remained very weak which curbed US support as ranges were very narrow.

There was defensive demand for the Japanese currency as risk appetite deteriorated and there was little enthusiasm for yen selling. There were further reports that the Bank of Japan was intervening in small quantities to prevent any renewed appreciation for the yen. There will still be the risk of capital repatriation as Euro fears intensify which could trigger fresh volatility.

Sterling

Sterling received a boost from the latest economic data as the construction PMI index rose to a five-month high of 53.9. The UK currency did, however, find tough resistance above 1.60 against the dollar and there were reports of ECB Euro buying against Sterling.

There will continue to be severe doubts surrounding the economic outlook, especially if there is a weaker than expected PMI services report. The NIESR also warned that there was at least a 50% chance that the economy would move back into recession as it cut growth forecasts for 2012

Risk conditions will be watched very closely in the short term with a renewed focus on the banking sector. There will be the threat of renewed capital repatriation by European and global banks as risk conditions deteriorate and this would pose a threat to the UK banks and Sterling. A wider US advance pushed Sterling to a test of support below 1.59 in Asia on Thursday.

Swiss franc

The dollar found support just below 0.88 during Wednesday and pushed to highs near 0.8880, although it was hampered by renewed franc gains on the crosses. The Euro dipped to the 1.2125 area against the Swiss currency and there were further reports that the National Bank might be intervening on the cross to stem further gains.

High volatility will remain an very important threat given a renewed focus on the European banking sector and there will be additional pressure on the central bank with the threat that there will be a renewed attack on the minimum Euro level.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

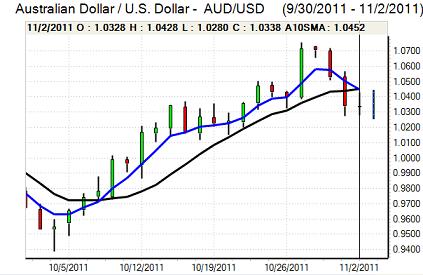

Australian dollar

The Australian dollar maintained a corrective tone for much of Wednesday, but there was selling on any move above the 1.04 area. The currency was subjected to renewed pressure from late in the US session and there was a sharp slide to lows near 1.02.

There were reports of corporate selling and there was also intense activity in the options market as fears over the Euro-zone and banking sector triggered demands for downside protection.

There was a marginally weaker than expected retail sales report with 0.4% growth for October which had a limited impact as global stresses dominated.