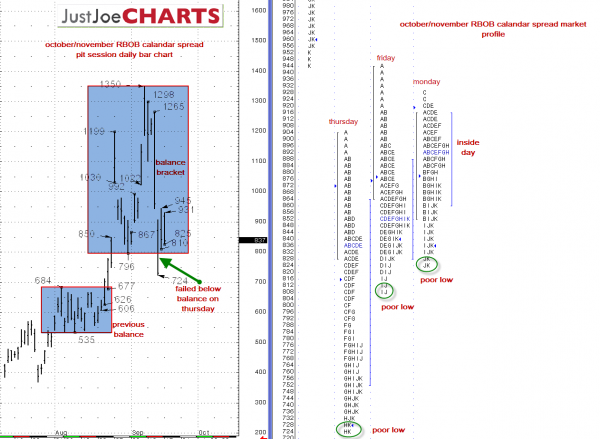

The spot RBOB calendar spread is one of the most volatile spreads in the energy markets. Many times when that spread starts off the day with a strong move in one direction, it finishes the day with a move in that same direction. Today, traders should be ready for the October/November RBOB calendar spread break from an inside day.

THREE POOR LOWS IN A ROW

A “poor low” on a Market Profile indicates a lack of a strong buying presence when the market was trading on the low of the day. A “poor low” lacks a buying tail (single letter prints) as opposed to two or more letters side by side (a “poor high” would lack a selling tail at the top of the daily range on a market profile). Many times a “poor low” is taken out within a few days. When a market has a few “poor lows” in a row, it makes the indication much stronger.

BE READY

The spread came into balance on Monday with an inside day (Mondays range was within Fridays range). The general rule of thumb is to go with breaks from inside days. Inside days are a form of balance and a lot of profitable trades start with a market breaking from a defined balance range.

OVERNIGHT INVENTORY IS LONG

Immediately after the pit session closed on Monday, the overnight session began to rally from the 836 settlement. The majority of the overnight trading took place above Mondays 931 high. If the market gets back into yesterdays range, it may put pressure on the overnight longs to liquidate their position, causing a long liquidation break early in the day.

KEY LEVELS

If the market gaps open higher, (above Mondays 931 high) and fails to close that gap, a key upside resistance level is 1055. If the market re enters Mondays range, look for it to test Mondays 825 poor low. If the market breaks from the inside day to the downside, look for it to test Thursdays 724 poor low.