August crude oil closed up $0.52 at $62.06 a barrel yesterday. Prices closed near the session high yesterday on more short covering and amid a rally in the stock market again yesterday. Bulls and bears are on a level near-term technical playing field. Prices are still in a three-week-old downtrend on the daily bar chart. The next downside price objective for the crude oil bears is to produce a close below solid technical support at this week’s low of $58.32. The next upside price objective for the bulls is producing a close above solid technical resistance at $65.00 a barrel. First resistance is seen at $62.50 and then at $63.00. First support is seen at $61.00 and then at yesterday’s low of $60.29.

Wyckoff’s Market Rating: 5.0.

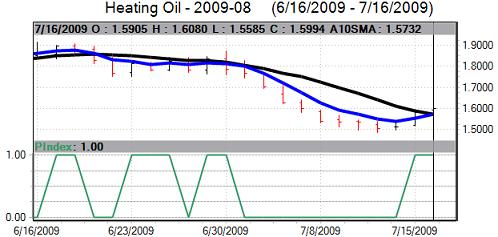

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 80% accurate. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

August heating oil closed up 174 points at $1.5995 yesterday. Prices closed nearer the session high yesterday on more short covering. Prices are still in a three-week-old downtrend on the daily bar chart. The bulls’ next upside price objective is closing prices above solid technical resistance at $1.7000. Bears’ next downside price objective is producing a close below solid technical support at this week’s low of $1.4871. First resistance lies at yesterday’s high of $1.6080 and then at $1.6250. First support is seen at yesterday’s low of $1.5585 and then at $1.5165.

Wyckoff’s Market Rating: 5.0.

August (RBOB) unleaded gasoline closed up 53 points at $1.7134 yesterday. Prices closed near the session high yesterday on more short covering. Prices are still in a four-week-old downtrend on the daily bar chart. The next upside price objective for the bulls is closing prices above solid technical resistance at $1.8000. Bears’ next downside price objective is closing prices below solid support at this week’s low of $1.6010. First resistance is seen at $1.7250 and then at $1.7500. First support is seen at yesterday’s low of $1.6807 and then at $1.6500.

Wyckoff’s Market Rating: 5.0.

August natural gas closed up 36.2 cents at $3.645 yesterday. Prices closed near the session high and scored a bullish “outside day” up on the daily bar chart yesterday. Short covering in a bear market was featured. If there is strong follow-through buying on Friday and a bullish weekly high close, then that would be an early technical clue that a market bottom is finally in place. But right now thebears are still in technical control. Prices are still in a four-week-old downtrend on the daily bar chart. The next upside price objective for the bulls is closing prices above solid technical resistance at $3.90. The next downside price objective for the bears is closing prices below solid technical support at the contract low of $3.225. First resistance is seen at yesterday’s high of $3.68 and then at $3.75. First support is seen at $3.50 and then at $3.35.

Wyckoff’s Market Rating: 2.5.