July crude oil closed down $0.77 at $76.90 a barrel yesterday. Prices closed near mid-range yesterday and were pressured by some weak U.S. economic data and some profit taking from recent gains. The bulls still have the slight overall nearterm technical advantage. My bias is that a market low is in place and that it’s likely price action will remain choppy and in a trading range between the May low of $67.15 and psychological resistance at $80.00. The next near-term upside price objective for the bulls is producing a close above solid technical resistance at $80.00 a barrel. The next near-term downside price objective for the crude oil bears is to produce a close below solid technical support at $74.00. First resistance is seen at $77.50 and then at this week’s high of $78.13. First support is seen at $76.00 and then at $75.00.

Wyckoff’s Market Rating: 5.5.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

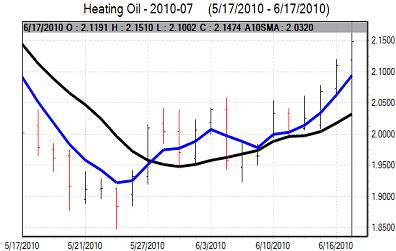

July heating oil closed up 367 points at $2.1465 yesterday. Prices closed near the session high yesterday and hit a fresh five-week high. Bulls have the near-term technical advantage. Prices are in a four-week-old uptrend on the daily bar chart. The bulls’ next upside price objective is closing prices above solid technical resistance at $2.2500. Bears’ next downside price objective is producing a close below solid technical support at $2.0000. First resistance lies at $2.1750 and then at $2.2000. First support is seen at $2.1000 and then at $2.0595.

Wyckoff’s Market Rating: 6.0.

July (RBOB) unleaded gasoline closed up 227 points at $2.1679. Prices closed nearer the session high yesterday and hit a fresh five-week high. Bulls have the near-term technical advantage. The next upside price objective for the bulls is closing prices above solid technical resistance at $2.2500. Bears’ next downside price objective is closing prices below solid support at $2.0000. First resistance is seen at yesterday’s high of $2.1751 and then at $2.2000. First support is seen at yesterday’s low of $2.1377 and then at $2.1000.

Wyckoff’s Market Rating: 6.0.

July natural gas closed up 18.0 cents at $5.158 yesterday. Prices closed near the session high yesterday. Recent price action suggests a major market low is in place in natural gas and that prices can continue to trend higher in the near term. Prices are in a three-week-old uptrend on the daily bar chart. The next upside price objective for the bulls is closing prices above solid technical resistance at $5.60. The next downside price objective for the bears is closing prices below solid technical support at $4.80. First resistance is seen at this week’s high of $5.196 and then at $5.25. First support is seen at $5.00 and then at $4.90.

Wyckoff’s Market Rating: 6.0.