Yesterday

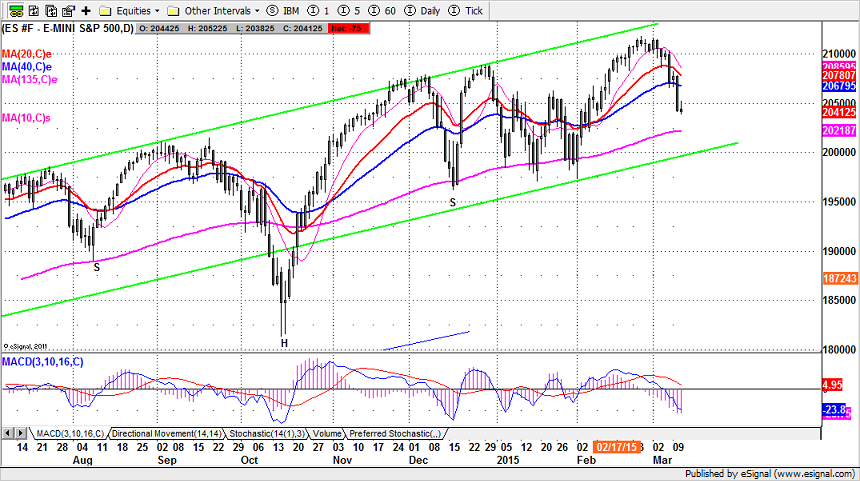

The S&P500 mini futures (ESH5) closed at 2039.50 yesterday (Weds.) after a day spent shucking back and forth within a very narrow consolidation range. It closed marginally (2.50 points) lower than the previous day, but the significant move was not the decline, rather, the long slow price consolidation between 2048-50 and 2038.50. This was a pause after the dramatics of Friday and Tuesday.

We don’t think this decline is finished, however, and we are expecting a further drop, especially as traders move out of the March contract and into the June contract. Given the difference in price between the two, we may see yesterday’s 2048-38 range become 2031-21 today and tomorrow. Whatever low is made in the next couple of days could well be the low right into the contract expiration next week.

That is for the short-term. For the longer-term, we may see the ES move even lower if it is unable to break above 2088-89.

Today

These are perilous times. Next week we have the FOMC meeting Tuesday and Wednesday, even as futures and options reach their expiration. The week after that is the end of Q1 when every fund manager with access to a trading account will be trying to goose the price… and the end-of-quarter bonus. The markets are going to be choppy and difficult to read for the remainder of March.

The short-term has an oversold condition after declining 5 of the past 7 days. The 135-day moving average line is just below the current price. We expect ES to bounce from it today or tomorrow if the price gets there. Right now, 2062.50-66.50 zone is resistance. As long as ES stays under it, the short-term trend is down, and any bounce may just act to release the oversold condition for a brief time.

- Major support levels: 2035.50-33.50, 2028-29, 2021-23.50

- Major resistance levels: 2062.50-66.50, 2088.75-89.50

ESH5 Daily Chart, Mar. 11, 2015

#####

Naturus.com publishes a free weekly analysis of US equity indices. To get on the mailing list, please click here.