Yesterday

The ESH5 stepped back from the rally yesterday and wandered down for a close 9.50 points below the previous close. It gapped down at the open, dropped to our support level around 2095, and moved back up in the afternoon to close at 2104.75. Volume, as usual, was weak, but about average for these times.

The lack of any real selling pressure on US equities was a little surprising, given the news in Europe and elsewhere. A colonel in the US army claimed in a speech that the US will have 1,000 troops in the Ukraine by the end of the week. A statement that went unnoticed here, but attracted lots of attention in Europe.

In Greece, the government is going to raid public pension plans to raise money to keep operating, a warning of what could happen in other countries, perhaps including the US. The Dallas Fed has just reduced its estimate of first quarter growth to 1.2% or about half of the previous consensus. Despite that, Actavis (ACT), the pharmaceutical company, was able to sell $21 billion of bonds rated just a little above junk status and yielding a princely 3.5%. It was the second biggest bond deal in history, and it was over-subscribed 4.5 times.

At least some of that might have been expected to dampen investors’ enthusiasm for equities. It did, but not much.

Today

The ADP employment report this morning will be significant, because traders will think it gives a clue about the more important non-farm payroll numbers coming on Friday. There are also two key economic reports being released after the open and three speeches by various Fed officials during the day. Should be fun.

Any whisper of a change even in the wording of the Fed’s stance on interest rates would be enough shake the market temporarily, but traders seem to be becoming pretty blasé about Fed pronouncements. They are starting to believe the Fed will not able to complete any substantial rise in interest rates this year. Party on!

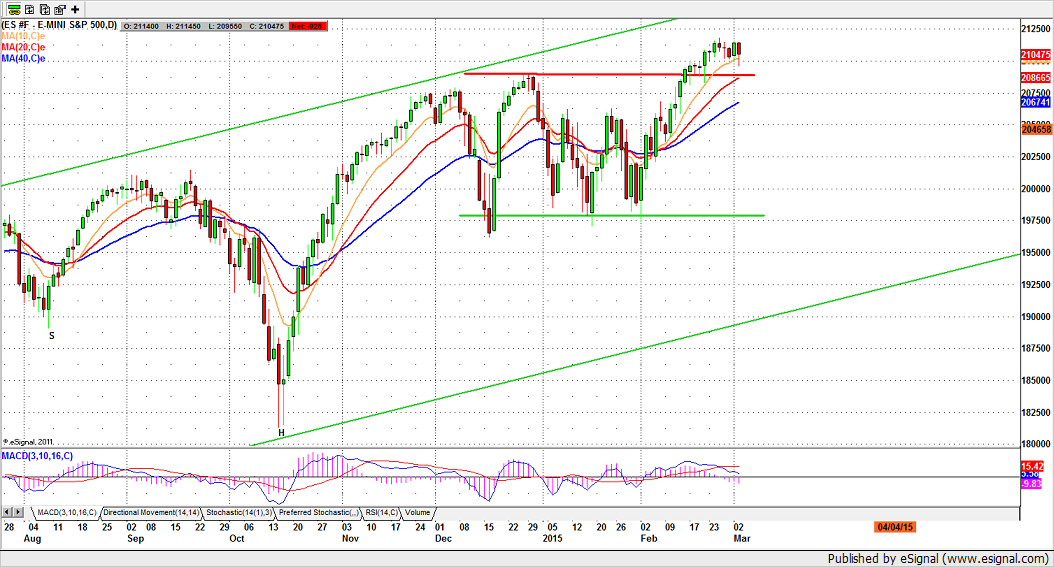

The resistance line was 2111 in yesterday’s regular session trading, and that will become the key line today. A break above it could push the price up to fill yesterday’s gap at 2114, and then perhaps higher to 2117.75 – 19.50 (short entry).

Remaining below 2111 could push the price back down to retest yesterday’s low at 2095.50 or lower to the lower support at 2089-92.

- Major support levels: 2092-88.50, 2065-68.50, 2056.50-54;

- Major resistance levels: 2118.50-19.50, 2123.50-21.75, 2128.50-29.50

ESH5 Daily Chart, Mar. 3, 2015

#####

Naturus.com publishes a free weekly analysis of US equity indices. To get on the mailing list, please click here.