Yesterday

In our pre-market summary yesterday, we pointed out that the short-term uptrend was intact, and mentioned 2112-2114 as a likely target for the S&P 500 mini futures (ESH5). We got our target – the market closed at 2114 – and the continuing rally is reassuring the bulls. Now, if only we could get some volume back into the market.

Right now, it looks as if it is only the machines trading with each other. The volume yesterday (1.2 million transactions) was about average for the new normal in the futures, but it is pretty forlorn in comparison to recent years.

Ordinary people have largely been driven out of the market (only 50% of American households have any exposure to the stock market, including through mutual funds and retirement plans), and the woeful trading volume has prompted a number of big institutions to close or curtail their trading desks. Turn off the terminals and close the trading floor; it’s just not profitable at these levels of activity.

None of that is disturbing the machines as they ramp the market higher, ever higher. Yesterday, we saw a little profit-taking during the pre-market Globex session, but the support at 2100 held, as we said it might, and after the open, the ES moved decisively back toward the record high (2117.75) made on Feb, 25.

It didn’t quite get there – the high for the day was 2115.50 – but there will be a determined attempt to get past that level, perhaps today.

Today

Today, we need to see some follow-through from yesterday’s rally. The volume needs to increase in order to support the attempt to make new highs. Based on the price action on yesterday’s move, ES should go higher to test 2117.75 at least.

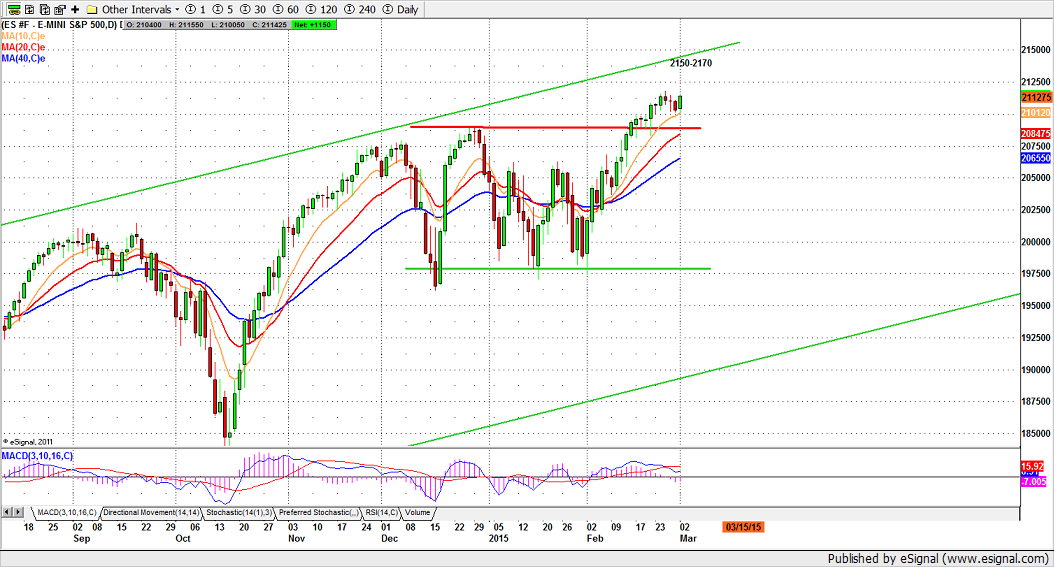

On the downside, 2100-98.50 is the first major support zone. As long as this support holds, the price is likely to grind slowly up to towards the long-term resistance line, the upper green line on the chart below.

- Major support levels: 2100-2097.50, 2092-88.50, 2065-68.50, 2056.50-54

- Major resistance levels: 2118.50-19.50, 2123.50-21.75, 2128.50-29

ESH5 Daily chart, Mar. 2M 2015

#####

Naturus.com publishes a free weekly analysis of US equity indices. To get on the mailing list to receive it, please click here.