Yesterday

The SP500 mini-futures (ESM5) struggled back from a sharp drop in overnight trading to close yesterday (Apr. 1) at 2053.00, about eight points below the previous close. That wasn’t much for the Bulls to cheer about, but it represented a substantial victory. At one point, the futures had been trading 20 points below that level.

There was no apparent reason, apart from the expiration of the monthly options, for the ES to deliver that kind of April Fools message to the Bulls. The Greek crisis remains unsolved, the Iran nuclear negotiations are extended, the eternal war with Oceania continues unabated – everything is unsettled but normal. Perhaps we are just seeing the markets losing faith in the Fed’s ability to keep the party going.

Now that’s really scary.

Today

Today we may see a further small bounce up to the 20/40 EMA lines for testing. This bounce may result from residual short covering before the holiday. We still expect any rally will not last very long.

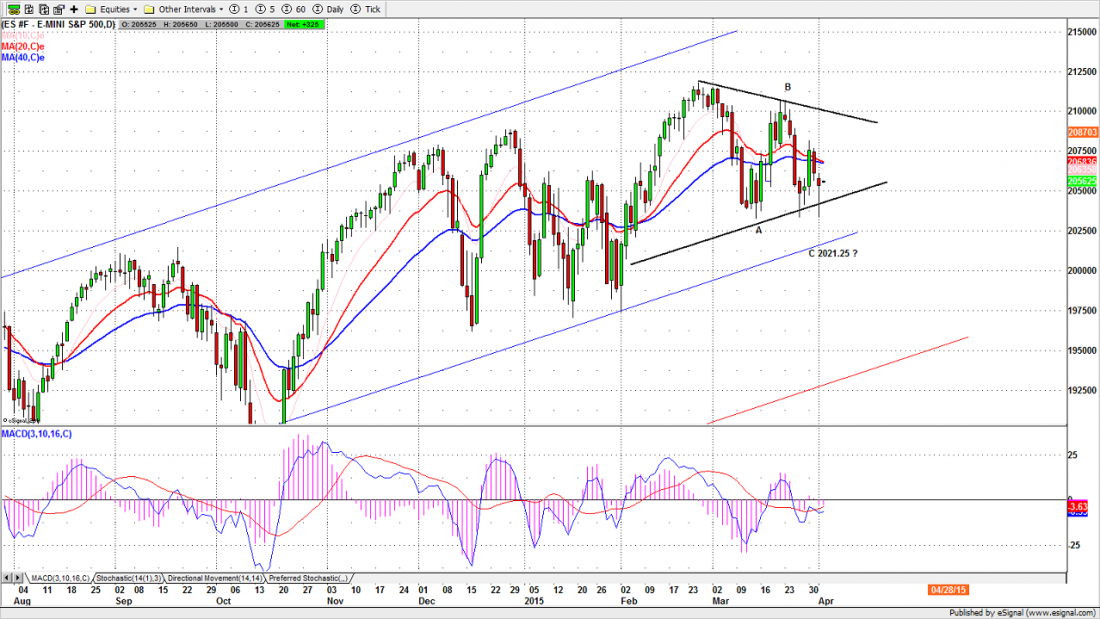

ES could stay inside yesterday’s range to keep the weekly option player happy. But as long as ES stays under 2068-70.50 zone, the short-term trend is down. The target for the A-B-C correction pattern is 2021.25 and that target is still in play.

So far, all our short-term indicators are bearish, and the daily pattern shows consolidation. Wednesday’s overnight low at 2033.50 could be retested once again in the coming days. If ES then drops below the 2028.50 line, it will open the path to 2000-1980 as the next target zone.

- Major support levels: 2045-43.25, 2035.50-33.50, 2028-29, 2015.50-14.50

- Major resistance levels: 2078-79.50, 2088.75-89.50, 2096-98.50

ESM5 Daily Chart, Apr. 1, 2014

#####

Naturus.com publishes a free weekly analysis of US equity indices. To get on the mailing list to receive it, please click here.