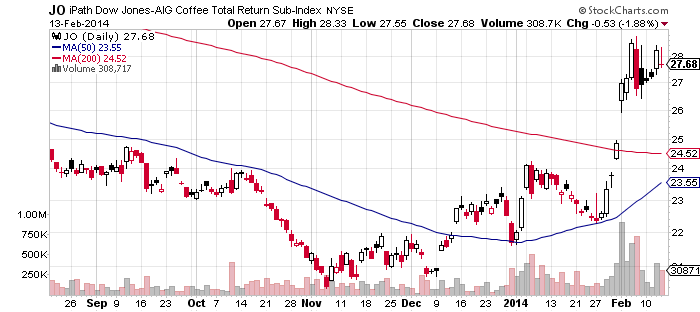

The recent spike in coffee futures has made the price of iPath Dow Jones-UBS Coffee Total Return Sub-Index ETN (JO) jump to a 2014 high. The volume is considerably higher than previous months and gives us some credence that this move is really bullish, possibly turning the negative sentiment wrapped around this market.

On the technical side, we can see how the price of this ETN has penetrated the 200 day moving average (red line) on the daily chart. When this happens, there is a change in sentiment and in the trend.

GROWING DEMAND

One of the consumer markets we have to take into account when studying this commodity is China. The world’s second-largest economy has a big stake in the coffee demand picture as it does with so many other commodities.

One of the reasons why coffee has been picking up in value is because consumption in China is expected to grow by an annual rate of 9% for the next 5 years.

FALLING PRODUCTION

On the other side, the ongoing drought in Brazil (the world’s largest producer of coffee) is clearly hitting the price of coffee.

Early forecasts put Brazilian production above 60 million bags this year, and now, the number has been reduced to 52 million bags, due to high temperatures and lack of rain. Rainfall has been 50% below average during the month of January.

Therefore, the investor market is now speculating that these hard weather conditions will persist into the next few months and potentially cause crop losses, further dampening supply and pushing up the price of the commodity.

ETF PLAY

There are two ways of trading JO:

The conservative way is to place a buy order at the center point of the gap, i.e., at $25,50 – $25,60.

The more aggressive way to enter is to simply buy at market as this ETN still has plenty room on the upside.

BOTTOM LINE

It was not that long ago (summer of 2011) that the price of coffee futures were trading at $3,00. As of now, the price is 60% less. With the technicals and fundamentals turning bullish, can coffee go back to that 2011 high? We will have to wait and see, but the truth is that it’s turning hot and attractive now for bullish traders.

Word of caution: since coffee futures are extremely volatile, it’s more prudent to trade this market via JO.

Happy Valentine’s Day!

===

Click here to see more of Daryanani’s work

RELATED READING

Read Darin Newsom (DTN)’s top commodities to watch in 2014 and why.