As the end of 2013 is approaching, there is one market that we should take into account that has given good returns for the year.

All of us hear about the active business that takes place in the Middle East and how big corporations have been making a strong effort to place a foot in that area.

One of the exchange traded products that tracks this area is the Market Vectors Gulf States Index ETF (MES). This ETF follows the performance of the largest and most liquid companies in the Gulf Cooperation Council (GCC) region and allocates almost 80% of its weight to UAE, Qatar and Kuwait in that order.

COMPOSITION

The sector weightings of this ETF are as follows:

48.37% – Financial Services

14.60% – Industrials

13.50% – Communication Services

13.02% – Real Estate

4.87% – Energy

4.39% – Basic Materials

1.25% – Utilities

PRICE BREAKOUT

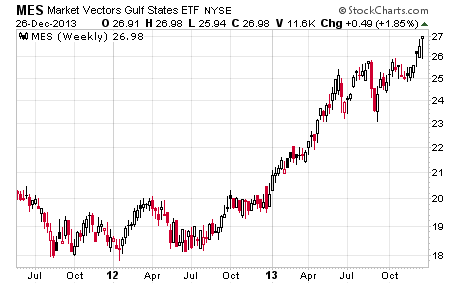

The price of this ETP has oscillated within the $18 to $20 range during the entire year of 2012 and has managed to break out from that locked range in early 2013.

The rally we can see on the weekly chart below represents a growth of almost 50% from 2012 until now and almost 40% during 2013 alone.

LOOKING FORWARD

The price is still on an upswing and can continue rising. If one wishes to enter the Middle Eastern market, MES is a perfect instrument to do so.