Traders may have finished the week feeling forsaken after Friday’s repeat bear performance in spite of an admirable recovery off of the prior week’s significant pullback. In fact, the S&P 500 (SPY) and Russell 2000 (IWM) finished higher a full +2.4% and +6.4%, respectively.

Traders may have finished the week feeling forsaken after Friday’s repeat bear performance in spite of an admirable recovery off of the prior week’s significant pullback. In fact, the S&P 500 (SPY) and Russell 2000 (IWM) finished higher a full +2.4% and +6.4%, respectively.

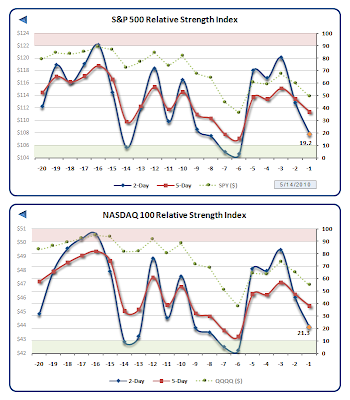

Meanwhile, commodities are beginning to look as oversold as the US Dollar is overbought. Unfortunately for the bulls, we cannot also say equities are oversold with volatility well on the rise. Indeed, fundamentals critically aside, a real cause for technical concern is the major deterioration of five of our tracked equity indices, now well below their respective 10-month moving averages.

Week Twenty of 2010 features the following economic and reporting calendars with a special focus on retail sales:

I hope you had a terrific weekend!

Never Investment Advice: Prior Weekly Summaries: ETF Rotation Models