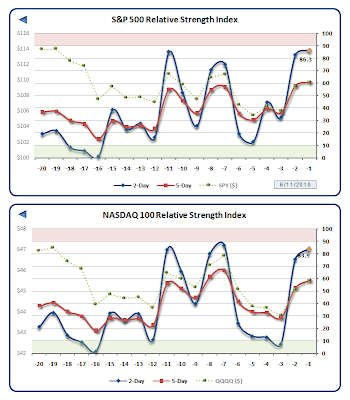

The market was able to repair itself somewhat last week with the S&P 500 (SPY) higher by +2.7%. While price action may face significant resistance just overhead and we are mildly short-term overbought, it was very encouraging this week to see select leading ETFs recapture their ten-month moving averages, including the Russell 2000 (IWM), Industrials (XLI), Transports (IYT), Consumer Discretionaries (XLY) and Real Estate (IYR). While it’s true that the most oversold indices often bounce the hardest, that is a seemingly bullish slate indeed.

The market was able to repair itself somewhat last week with the S&P 500 (SPY) higher by +2.7%. While price action may face significant resistance just overhead and we are mildly short-term overbought, it was very encouraging this week to see select leading ETFs recapture their ten-month moving averages, including the Russell 2000 (IWM), Industrials (XLI), Transports (IYT), Consumer Discretionaries (XLY) and Real Estate (IYR). While it’s true that the most oversold indices often bounce the hardest, that is a seemingly bullish slate indeed.

Week Twenty-Four of 2010 brings key housing, industrial production and inflation numbers, as follows:

I hope you have a terrific weekend!

Never Investment Advice: Prior Weekly Summaries: ETF Rotation Models