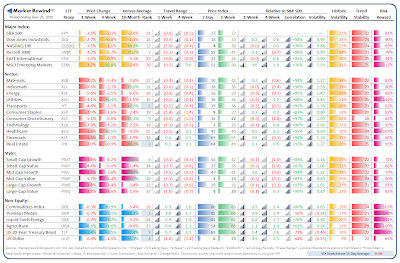

Our technical rotation models’ call to remain in currencies and bonds ended up being the correct one as equities moved relentlessly lower for a -3.5% week-over-week decline in the S&P 500 (SPY). Even worse off were Consumer Discretionaries (XLY -5.1%) and Energy (XLE -5.6%) on the slower than anticipated final GDP readings. However, breadth and short-term relative strength indicators hooked a bit higher Friday, we’ll see if that can’t mount into a small recovery going into the end-of-month/ quarter.

Our technical rotation models’ call to remain in currencies and bonds ended up being the correct one as equities moved relentlessly lower for a -3.5% week-over-week decline in the S&P 500 (SPY). Even worse off were Consumer Discretionaries (XLY -5.1%) and Energy (XLE -5.6%) on the slower than anticipated final GDP readings. However, breadth and short-term relative strength indicators hooked a bit higher Friday, we’ll see if that can’t mount into a small recovery going into the end-of-month/ quarter.

The mid-point of the year, Week Twenty-Six of 2010 brings the following busy reporting calendars:

I hope you have a terrific weekend!

Never Investment Advice: Prior Weekly Summaries: ETF Rotation Models