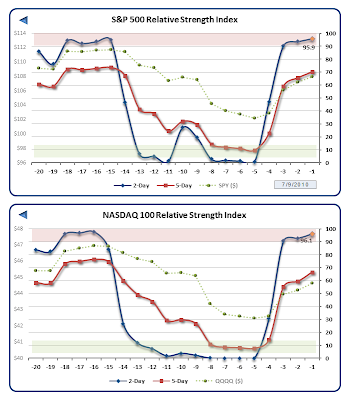

The market finally got its reversal, repairing most of the prior week’s damage, leaving the S&P 500 (SPY) higher by +5.1% for the best weekly performance of the year. However, we are now just as short-term overbought as we were recently oversold, and only earnings will tell where we go from here.

The market finally got its reversal, repairing most of the prior week’s damage, leaving the S&P 500 (SPY) higher by +5.1% for the best weekly performance of the year. However, we are now just as short-term overbought as we were recently oversold, and only earnings will tell where we go from here.

Week Twenty-Eight of 2010 presents the following reporting calendars featuring retail sales, the FOMC minutes, and the start of Q2 earnings:

- U.S. Economic Calendar

- U.S. Earnings Calendar

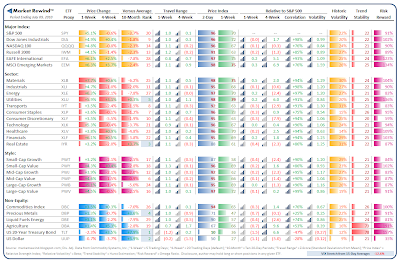

- ETF Rotation Models [Custom]

- CSS Analytics/ Varadi Aggregate M&Z Now Part of ETFR!

Lastly, in accordance with a more positive intermediate-term outlook, I noted a couple of more encouraging historical analogues popping up on our weekly simile analysis, provided here. I will be on vacation next week — have a good one!

Never Investment Advice: Prior Weekly Summaries: ETF Rotation Models