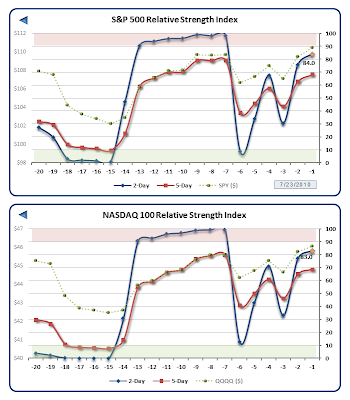

Equities rebounded last week, breaking down-channel resistance and registering higher lows. In fact, the S&P 500 (SPY) managed to break above its fifty-day moving average and came within a hair of going positive relative to its ten-month moving average, finishing higher by +3.5% on the week. The major indices are slightly overbought going into the final week of July, but only mildly so and with the European Bank “Stress-Tests” out of the way and a predominance of upside earnings surprises, I’d suppose at least even odds that markets can continue to repair the last couple months’ damage.

Equities rebounded last week, breaking down-channel resistance and registering higher lows. In fact, the S&P 500 (SPY) managed to break above its fifty-day moving average and came within a hair of going positive relative to its ten-month moving average, finishing higher by +3.5% on the week. The major indices are slightly overbought going into the final week of July, but only mildly so and with the European Bank “Stress-Tests” out of the way and a predominance of upside earnings surprises, I’d suppose at least even odds that markets can continue to repair the last couple months’ damage.

Week Thirty of 2010 features a busier economic reporting calendar including Housing, Beige Book and Gross Domestic Product estimates:

I hope you are having a terrific weekend!

Never Investment Advice: Prior Weekly Summaries: ETF Rotation Models