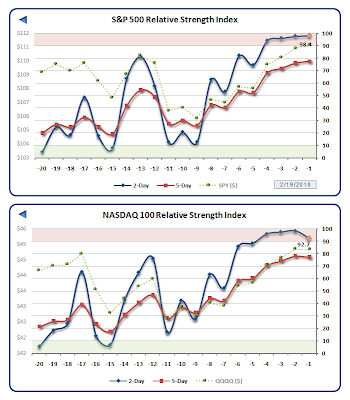

Markets continued their corrective recovery with the S&P 500 (SPY) finishing the week higher by another +2.8%. However, while last week we intimated it might be premature to act on overbought readings, this week they are fairly screaming for a minimal pause in the rise. In addition, momentum slowed to the extent of divergence on Friday in spite of the impressive reversal from the surprise Federal Reserve discount rate increase.

Markets continued their corrective recovery with the S&P 500 (SPY) finishing the week higher by another +2.8%. However, while last week we intimated it might be premature to act on overbought readings, this week they are fairly screaming for a minimal pause in the rise. In addition, momentum slowed to the extent of divergence on Friday in spite of the impressive reversal from the surprise Federal Reserve discount rate increase.

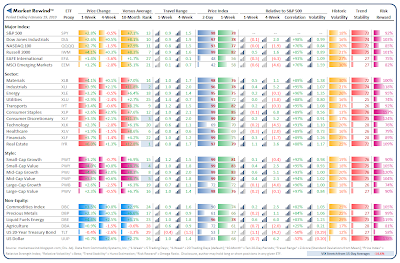

That said, more broadly speaking last week’s strength was just the type of action needed to lessen fears of a third leg down beyond mere correction levels. In fact, two of our three simple rotation models put the risk trade back on, legging back into into the NASDAQ 100 (QQQQ).

Week Eight of 2010 features the following reporting calendars and rotation model selections:

Lastly, don’t forget that with Chinese traders back from vacation and Greece seeking to place a large debt offering, overseas news will be back in the limelight. Have a terrific weekend!

Never Investment Advice: Prior Weekly Summaries: ETF Rotation Models