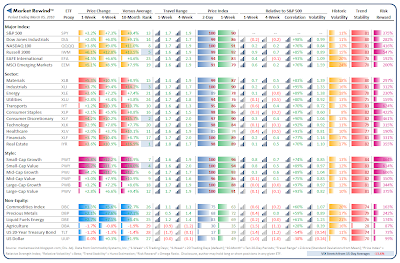

A better than expected jobs report pushed overbought conditions to extremes, leaving the Weekly ETF Rewind looking as extended as I have ever seen it. While this may be suggestive of an imminent pause or retrace, it is also emblematic of the persistent strength that this market has shown, and I’ll frankly be more surprised than not if we don’t see a near-term breakout of the S&P 500 to match its major index brethren at new bull-market highs. In fact, the strong week left the S&P 500 (SPY) and Russell 2000 (IWM) higher by +3.2% and +6.1%, respectively.

A better than expected jobs report pushed overbought conditions to extremes, leaving the Weekly ETF Rewind looking as extended as I have ever seen it. While this may be suggestive of an imminent pause or retrace, it is also emblematic of the persistent strength that this market has shown, and I’ll frankly be more surprised than not if we don’t see a near-term breakout of the S&P 500 to match its major index brethren at new bull-market highs. In fact, the strong week left the S&P 500 (SPY) and Russell 2000 (IWM) higher by +3.2% and +6.1%, respectively.

Going into the one-year anniversary of the bear-market reversal, Week Ten of 2010 includes a somewhat lighter economic reporting calendar where retail sales promises to play a prominent role, as follows:

Have a terrific weekend!

Never Investment Advice: Prior Weekly Summaries: ETF Rotation Models