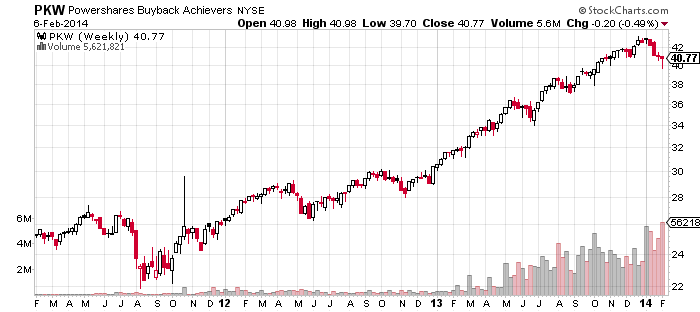

One of the exchange traded products that has recently caught my attention is the PowerShares Buyback Achievers Portfolio (PKW). This ETF has close to $2.5 billion in assets under management and has risen in its price over 60% in 2012 and 2013 combined.

PKW tracks the NASDAQ US BuyBack Achievers Index, which is comprised of US securities issued by corporations that have effected a net reduction in shares outstanding of 5% or more in the past 12 months. Not every stock qualifies for entry in this ETF due to their requirements.

WHY BUYBACK SHARES

There are many reasons why listed companies buyback their own stock. One of them is to increase their earnings per share ratio. Since Wall Street glorifies EPS, this should serve to increase the stock price.

Share repurchase plans also gives the view to the general public that the company’s management considers their stock to be cheap enough to buy.

Another reading is that the company is buying back shares because they have ample cash lying around.

APPLE TO JOIN

One of the companies that is on its way to enter this ETF is Apple Inc. (AAPL) as it announced in April 2013 a buyback plan of $60 billion. However, in fiscal 2013, the iPad maker bought back only $23 billion of its own stock. This still made AAPL the largest repurchase in the U.S. market last year.

PKW rebalances every quarter and is due to a revision of its holdings in April, and is looking to put some AAPL stock under its belt.

PKW holdings are all top notch companies and as of 30th January 2014 the top five are Pfizer (PFE) 5.19%, Oracle (ORCL) 5.04%, AT&T (T) 4.95%, Home Depot (HD) 4.88%, and General Motors (GM) 3.16%.

BOTTOM LINE

It’s important not to confuse buyback of shares with inside buys. Inside buying tends to lean towards cheap stocks and with an upcoming unannounced profitable project. Companies that announce share buybacks are well capitalized with operations running smoothly.

As this ETF is currently on a pullback, a good level for aggressive traders to enter PKW would be under the $40 level. More conservative investors could wait to see if the retracement is deeper and enter once the price holds.

===

Click here to see more of Daryanani’s work

Stay tuned! The Winter TraderPlanet Journal —a quarterly educational magazine for active traders will be released on Monday. Subscribe here for free.