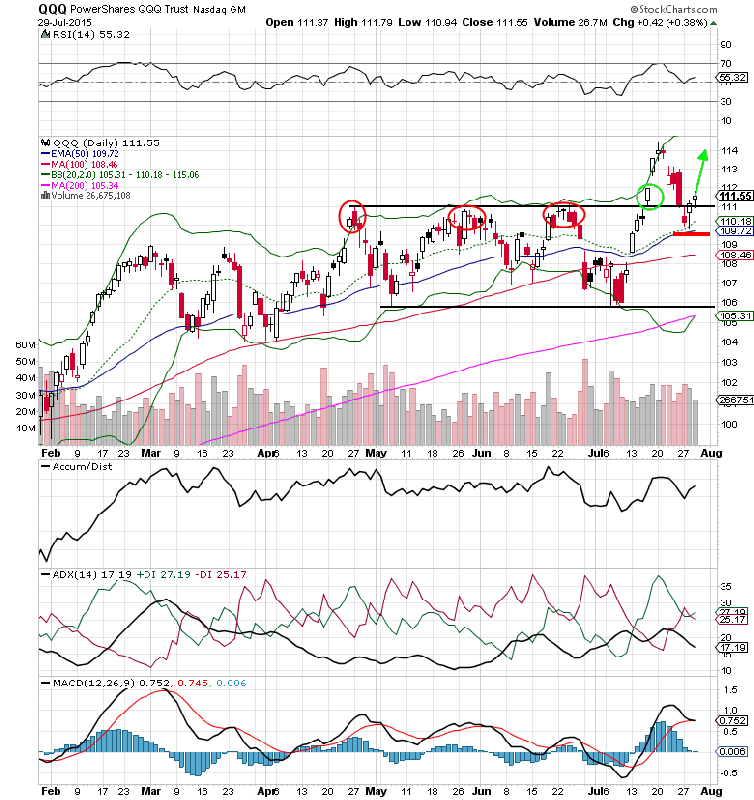

Two weeks ago, I talked about the failed breakout at the $111 level in the Nasdaq-100 ETF.

The QQQ ended up testing the $108 level last week and actually broke down below it (and the 100-day simple moving average) momentarily. Hope out of the Greece situation allowed for a relief rally back to $108 and even a massive reversal on July 7th from the intra-day lows.

In what appeared to be yet another textbook bounce off of the 200-day simple moving average in the S&P 500 like we’ve saw so many times over the last 1-2 years isn’t playing out this time. Along with Greece, China, and Puerto Rico woes, now investor confidence is being shaken after the NYSE trading floor was halted for more than 3 hours on July 7th.

That same day the QQQ’s fell 1.74%, closing near the closes of the week. With the Dow Jones Industrial Average and S&P 500 already hitting their 200-day simple moving average, now it is time for the Nasdaq-100 (and similar ETFs) to test their long-term trend lines. Looking at the chart below we can see that $104 would be the likely next support level to come into play in the coming weeks. Apple, the largest holding accounting for 14% of the ETF, is rolling over at a much faster rate, which doesn’t help matters either.