By FXEmpire.com

EUR/CHF Fundamental Analysis April 12, 2012, Forecast

Analysis and Recommendations:

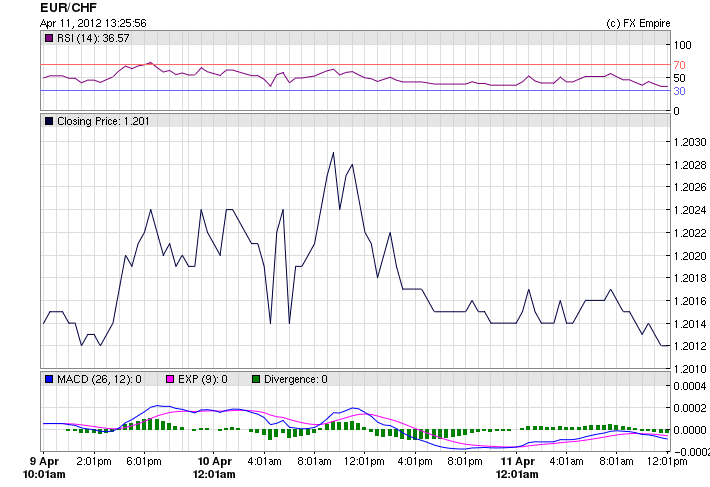

EUR/CHF is trading at 1.2011 pushing the SNB floor. The pair hit a low of 1.2010 as speculators tried to push the currency down to force the SNB move.

News from the Switzerland was quiet and subdued, and news from the eurozone was in decisive. Investors continued to worry about financial problems from Spain and Italy, but worries were offset by comments from the Spanish Prime Minister.

The yields on Spanish bonds fell today but markets were cautious as the cost of the country’s borrowings hit four-month highs earlier this week. The interest rate a country pays to borrow on international debt markets, which is also an indicator of risk, for the country’s 10-year-bonds dropped to 5.87pc in the secondary market from 5.93pc.

There is growing concern about Spain’s ability to cut its national debt and pull itself out of recession at a time when unemployment is at over 20pc.

These concerns prompted Prime Minister Rajoy to address the issue but he also said that Spain will not need a bailout. He said the country’s problems are “difficult and complicated.”

Industrial production in Spain fell 5.1% in February on an annual basis, the national statistics office reported on Wednesday. That compares to a 4.3% fall, revised down from 4.2%, in January. On a monthly basis, industrial production fell 3% against a 2.5% drop in January. The statistics office said all industrial sectors, outside of energy, showed monthly drops in production, and all 12 autonomous communities recorded negative production in February.

The ECB’s securities market programme (SMP), which has not purchased European bonds since the March 9th purchase of just EUR27m and has not participated in more significant way since the January 20th purchase of EUR2.2bn is suddenly back on investors’ radars. ECB member Coeure suggested the program could be used to support the Spanish market. Today, there was a weak Italian T-bill auction, but longer end yields in Italy and Spain have dropped lower (19 and 15bpts respectively), suggesting that there has been some easing of pressure in the bond market, which is positive for EUR. The other interesting market theme is how vulnerable the Spanish banks who participated in the ECB’s LTRO are to rising yields. If even some of the ECB loans were reinvested into Spanish sovereigns (carry trade), rising yields could be creating mark-to-market losses for the banks at an already difficult time. This would present a significant problem for the ECB and one that they are unlikely to stand passively beside

Economic Reports April 11, 2012 actual v. forecast

|

Apr. 11 |

AUD |

Westpac Consumer Sentiment |

-1.60% |

-5.00% |

|

AUD |

Home Loans (MoM) |

-2.5% |

-3.5% |

-1.1% |

|

JPY |

BoJ Monthly Report |

|||

|

HUF |

Hungarian CPI (YoY) |

5.5% |

5.7% |

5.9% |

|

EUR |

German 10-Year Bund Auction |

1.770% |

1.830% |

|

|

Housing Starts |

216K |

200K |

205K |

|

|

USD |

Import Price Index (MoM) |

1.3% |

0.8% |

-0.1% |

Economic Events for April 12, 2012

06:30 EUR French CPI (MoM) 0.4%

The French Consumer Price Index (CPI) measures the changes in the price of goods and services purchased by consumers.

08:30 EUR Dutch Retail Sales (YoY) 0.80%

Retail trade is a form of trade in which goods are mainly purchased and resold to the consumer or end-user, generally in small quantities and in the state in which they were purchased (or following minor transformations).

09:30 GBP Trade Balance -7.7B -7.5B

The Trade Balance measures the difference in value between imported and exported goods and services over the reported period. A positive number indicates that more goods and services were exported than imported.

10:00 EUR Industrial Production (MoM) -0.2% 0.2%

Industrial Production measures the change in the total inflation-adjusted value of output produced by manufacturers, mines, and utilities.

10:00 EUR Portuguese CPI (MoM) 0.10%

The Consumers Price Index (CPI) measures the rate of price change of goods and services purchased by households. It measures changes in the average level of prices over a period of time. In other words, prices indicator of what is happening to prices consumers are paying for items purchased. With a given starting point or base period which is usually taken as 100, the CPI can be used to compare current period consumer prices with those in the base period. Consumer Price index is the most frequently used indicator of inflation and reflect changes in the cost of acquiring a fixed basket of goods and services by the average consumer. The weights are usually derived from household expenditure surveys.

10:00 EUR Greek Unemployment Rate 21.00%

The definition for an unemployed person is: Persons (16-65 years) who were available for work (except for temporary illness) but did not work during the survey week, and who made specific efforts to find a job within the previous 4 weeks by going to an employment agency, by applying directly to an employer, by answering a job ad, or being on a union or professional register. The percentage number is calculated unemployed / (employed + unemployed).

13:30 CAD Trade Balance 2.0B 2.1B

The Trade Balance measures the difference in value between imported and exported goods and services over the reported period. A positive number indicates that more goods and services were exported than imported.

13:30 USD Core PPI (MoM) 0.2% 0.2%

13:30 USD PPI (MoM) 0.3% 0.4%

The Core Producer Price Index (PPI) measures the change in the selling price of goods and services sold by producers, excluding food and energy. The PPI measures price change from the perspective of the seller. When producers pay more for goods and services, they are more likely to pass the higher costs to the consumer, so PPI is thought to be a leading indicator of consumer inflation. The Producer Price Index (PPI) measures the change in the price of goods sold by manufacturers. It is a leading indicator of consumer price inflation, which accounts for the majority of overall inflation.

13:30 USD Trade Balance -52.0B -52.6B

The Trade Balance measures the difference in value between imported and exported goods and services over the reported period. A positive number indicates that more goods and services were exported than imported.

13:30 USD Initial Jobless Claims 355K 357K

13:30 USD Continuing Jobless Claims 3335K 3338K

Initial Jobless Claims measures the number of individuals who filed for unemployment insurance for the first time during the past week. This is the earliest U.S. economic data, but the market impact varies from week to week. Continuing Jobless Claims measures the number of unemployed individuals who qualify for benefits under unemployment insurance.

Government Bond Auctions April 10-20, 2012

Apr 12 09:10 Italy BTP/CCTeu auction

Apr 12 09:30 UK Gbp 2.0bn 4.25% Jun 2032 Conventional Gilt

Apr 12 15:00 US Announces auction of 5Y TIPS on Apr 19

Apr 12 17:00 US Auctions 30Y Bonds

Apr 13 10:00 Belgium OLO mini bond auction

Apr 16-30 n/a UK Re-opened 3.75% 2052 Conventional Gilt syndication

Apr 16 09:10 Slovakia Auctions floating rate Nov 2016 & 4.35% Oct 2025 & Bonds

Apr 16 09:10 Norway T-bill auction

Apr 17 08:30 Spain 12 & 18M T-bill auction

Apr 17 09:30 Belgium Auctions 3 & 12M T-bills

Apr 18 09:10 Sweden Nominal bond auction

Apr 18 09:30 Germany Eur 5.0bn 0.25% Mar 2014 Schatz

Apr 18 14:30 Sweden Details T-bill auction on Apr 25

Apr 19 08:30 Spain Obligacion auction

Apr 19 08:50 France BTAN auction

Apr 19 09:30 UK Auctions 0.125% I/L Gilt 2029

Apr 19 09:50 France OATi auction

Originally posted here