By FXEmpire.com

EUR/CHF Fundamental Analysis April 17, 2012, Forecast

Analysis and Recommendations:

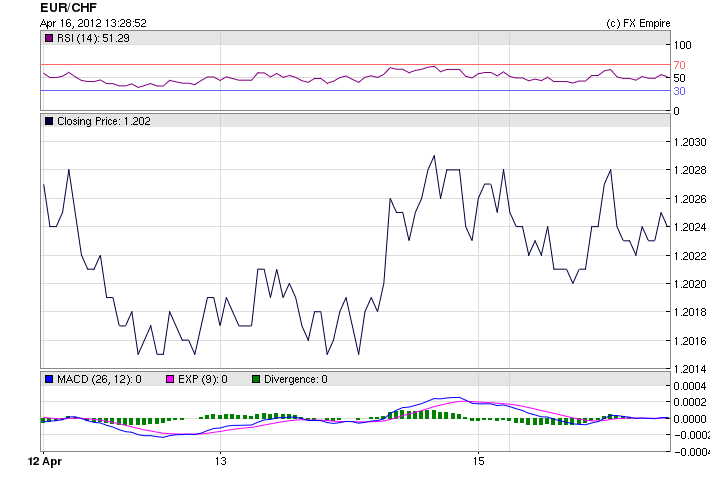

The EUR/CHF is trading at 1.2019 remaining in a very tight range, the pair had closed the week at 1.2020 and traded today between 1.2031 and 1.2018 ending the day at the bottom of the range. The euro picked up a bit of strength against the Swissie after Swiss PPI reported lower the forecast results. If the SNB was not so vigilant about the 1.20 floor, the pair most likely would continue to drop.

But the pressure on the euro was relentless today. The markets complete attention was focused on Spain with stories, news, and statements covering news and blogs around the globe.

French President Nicolas Sarkozy, locked in a tough reelection fight, on Sunday said he would seek a debate on expanding the European Central Bank’s mandate to include efforts to support growth across the 17-nation single-currency area.

Jorg Asmussen, Germany’s representative on the European Central Bank’s six-member executive board, called on non-European members of the International Monetary Fund to put up more money for use by the IMF in crisis situations.

Britain is close to agreeing to a new ?10 billion commitment to the International Monetary Fund as the Bretton Woods institution seeks to double its war-chest at its spring meeting this week, The Daily Telegraph reported.

A Spanish minister has urged the European Central Bank (ECB) to buy more bonds to slow the country’s sovereign debt crisis, amidst fears that Spain will be the next euro member in need of a bail-out.

Spanish and Italian government bonds saw renewed pressure Monday, pushing Spain’s 10-year yield above the psychologically important 6% level.

Spanish government bonds trimmed earlier losses, with the yield on the 10-year Spanish government bond slipping back below the 6% threshold after stronger-than-expected U.S. retail sales data boosted global risk appetite.

The Spanish government could be poised to take over the financial dealings of some of its indebted regions, citing senior government officials.

European Commission President Jose Manuel Barroso on Monday said the European Union’s executive arm remains confident Spain’s government can meet its economic challenges.

Economic Reports for April 16, 2012 actual v. forecast

|

GBP |

Rightmove House Price Index (MoM) |

2.9% |

1.6% |

|

|

JPY |

BoJ Governor Shirakawa Speaks |

|||

|

CHF |

PPI (MoM) |

0.3% |

0.5% |

0.8% |

|

USD |

Core Retail Sales (MoM) |

0.8% |

0.6% |

0.9% |

|

Foreign Securities Purchases |

12.50B |

7.23B |

-4.28B |

|

|

USD |

Retail Sales (MoM) |

0.8% |

0.3% |

1.0% |

|

USD |

NY Empire State Manufacturing Index |

6.6 |

18.0 |

20.2 |

|

USD |

TIC Net Long-Term Transactions |

10.1B |

41.3B |

102.4B |

Economic Events scheduled for April 17, 2012 that affect the European and American Markets

09:30 GBP CPI (YoY) 3.4%

The Consumer Price Index (CPI) measures the change in the price of goods and services from the perspective of the consumer. It is a key way to measure changes in purchasing trends and inflation.

10:00 EUR CPI (YoY) 2.6% 2.6%

The Consumer Price Index (CPI) measures the change in the price of goods and services from the perspective of the consumer. It is a key way to measure changes in purchasing trends and inflation.

10:00 EUR German ZEW Economic Sentiment 19.0 22.3

The German Zentrum f?r Europ?ische Wirtschaftsforschung (ZEW) Economic Sentiment Index gauges the six-month economic outlook. A level above zero indicates optimism; below indicates pessimism. The reading is compiled from a survey of about 350 German institutional investors and analysts.

10:00 EUR Core CPI (YoY) 1.5%

The Core Consumer Price Index (CPI) measures the change in the price of goods and services purchased by consumers, excluding food, energy, alcohol, and tobacco. The data has a relatively mild impact because overall CPI is the European Central Bank’s mandated inflation target.

13:30 USD Building Permits 0.71M 0.71M

Building Permits measures the change in the number of new building permits issued by the government. Building permits are a key indicator of demand in the housing market.

13:30 USD Housing Starts 0.70M 0.70M

Housing starts measures the change in the annualized number of new residential buildings that began construction during the reported month. It is a leading indicator of strength in the housing sector.

14:15 USD Industrial Production (MoM) 0.5%

Industrial Production measures the change in the total inflation-adjusted value of output produced by manufacturers, mines, and utilities.

Government Bond Auctions (this week)

Apr 17 08:30 Spain 12 & 18M T-bill auction

Apr 17 09:30 Belgium Auctions 3 & 12M T-bills

Apr 18 09:10 Sweden Nominal bond auction

Apr 18 09:30 Germany Eur 5.0bn 0.25% Mar 2014 Schatz

Apr 18 14:30 Sweden Details T-bill auction on Apr 25

Apr 19 08:30 Spain Obligacion auction

Apr 19 08:50 France BTAN auction

Apr 19 09:30 UK Auctions 0.125% I/L Gilt 2029

Apr 19 09:50 France OATi auction

Originally posted here