By FXEmpire.com

EUR/CHF Fundamental Analysis April 3, 2012, Forecast

Analysis and Recommendations:

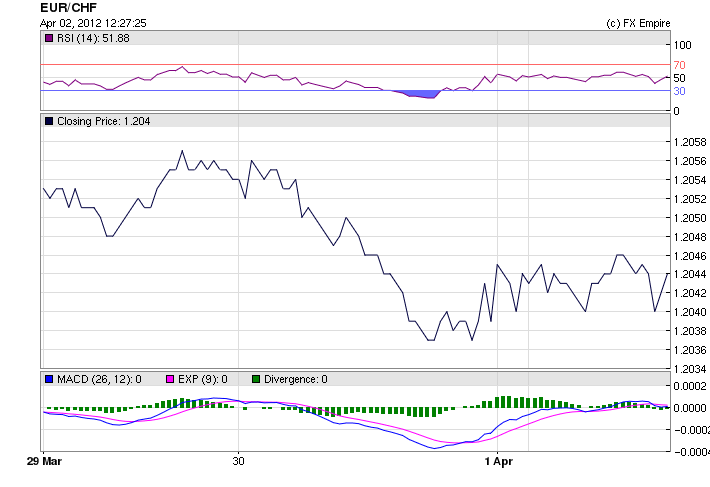

The EUR/CHF is trading at 1.2040, and it seems froze in place. The pair had little price movement today and seems to be duplicating last week’s action. They remained in a tight range opening this morning at 1.2041 and remained in the channel between 1.2038 and 1.2048.

There was little response to the activity in the Eurozone and with slight bounces as the Swiss ISM and retail sales reports were released with retail sales falling way below estimates and SVME PMI reporting slightly above expectations.

In the eurozone ISM reports were release for several of the larger manufacturing countries. The data showed Eurozone March final manufacturing PMI 47.7, French March final manufacturing PMI 46.7, Italian March manufacturing PMI 47.9, Spain March manufacturing PMI 44.5 down from 45.0 in February and lowest read since December. Irish manufacturing PMI rises to 51.5 in March

The head of Germany’s Ifo economic research institute, Hans-Werner Sinn, sees no end to the Eurozone’s sovereign debt crisis. “One has to fear that the current account deficits will remain for a longer time and that the debt crisis in the southern [European] states will worsen again,” Sinn told German business weekly Wirtschaftswoche in an interview published today.

Not even the rise in Eurozone Unemployment seemed to have an effect on this pair today.

Economic Data for April 2, 2012 actual v. forecast

|

00:00 |

KRW |

South Korean CPI (YoY) |

2.6% |

3.1% |

3.1% |

|

00:50 |

JPY |

Tankan Large Manufacturers Index |

-4 |

-1 |

-4 |

|

02:30 |

AUD |

Building Approvals (MoM) |

-7.8% |

0.3% |

1.1% |

|

06:05 |

INR |

Indian Trade Balance |

-15.2B |

-13.0B |

-14.8B |

|

08:00 |

DKK |

Danish Retail Sales (YoY) |

-0.5% |

-1.7% |

-3.3% |

|

08:15 |

CHF |

Retail Sales (YoY) |

0.8% |

3.2% |

4.7% |

|

08:30 |

CHF |

SVME PMI |

51.1 |

49.5 |

49.0 |

|

08:50 |

EUR |

French Manufacturing PMI |

46.7 |

47.6 |

47.6 |

|

08:55 |

EUR |

German Manufacturing PMI |

48.4 |

48.1 |

48.1 |

|

09:00 |

EUR |

Manufacturing PMI |

47.7 |

47.7 |

47.7 |

|

09:30 |

GBP |

Manufacturing PMI |

52.1 |

50.5 |

51.5 |

|

10:00 |

EUR |

Unemployment Rate |

10.8% |

10.8% |

10.7% |

|

15:00 |

USD |

ISM Manufacturing Index |

53.4 |

53.0 |

52.4 |

Economic Events scheduled for April 3, 2012 that affect the European and American Markets

T.B.D GBP Halifax House Price Index (MoM) -0.3% -0.5%

The Halifax House Price Index measures the change in the price of homes and properties financed by Halifax Bank of Scotland (HBOS), one of the U.K.’s largest mortgage lenders. It is a leading indicator of health in the housing sector.

10:00 EUR GDP (QoQ) -0.3% -0.3%

Gross Domestic Product (GDP) measures the annualized change in the inflation-adjusted value of all goods and services produced by the economy. It is the broadest measure of economic activity and the primary indicator of the economy’s health.

19:00 USD FOMC Meeting Minutes

The Federal Open Market Committee (FOMC) Meeting Minutes are a detailed record of the committee’s policy-setting meeting held about two weeks earlier. The minutes offer detailed insights regarding the FOMC’s stance on monetary policy, so currency traders carefully examine them for clues regarding the outcome of future interest rate decisions.

Government Bond Auctions (this week)

Apr 03 09:30 Belgium Auctions 3 & 6M T-bills

Apr 03 09:30 UK Conventional Gilt Auction

Apr 04 08:30 Spain Bono auction

Apr 04 14:30 Sweden Details T-bill auction on Apr 11

Apr 05 08:50 France OAT auction

Apr 05 15:00 US Announces auctions

Apr 05 15:30 Italy Details BOT on Apr 11 & BTP/CCTeu on Apr 12

Originally posted here