By FXEmpire.com

EUR/CHF Weekly Fundamental Analysis April 16-20, 2012, Forecast

Introduction: News from the Euro and Swiss zone. EUR/CHF is frequently chosen for carry trades which involves going long a high-yielding currency (EURO – 3.50%) against a low-yielding one (CHF – 1.50%). Traders earn daily interest fees when holding this pair long (rollover fees).

- The interest rate differential between the European Bank(ECB) and the Swiss National Bank(SNB)

- Swiss and Euro zone fundamentals

Analysis and Recommendations:

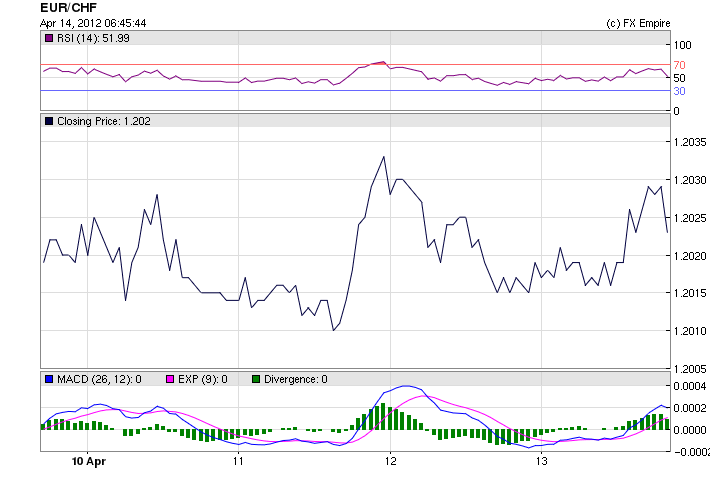

The EUR/CHF has been staying just above the SNB floor of 1.20 all week, closing the week at 1.2026. The pair remained in a tight range all week. The EUR exhibited weakness most of the latter half of the week, which did not follow through here. On April 5, the SNB was forced to react as the EUR fell below the level to trade at 1.1995 for a few minutes. This is little in the way of supporting data from the Swiss to help support the Franc.

|

Date |

Open |

High |

Low |

Change % |

|

|

04/13/2012 |

1.2026 |

1.2019 |

1.2030 |

1.2014 |

0.06% |

|

04/12/2012 |

1.2019 |

1.2033 |

1.2033 |

1.2013 |

-0.12% |

|

04/11/2012 |

1.2033 |

1.2013 |

1.2034 |

1.2008 |

0.17% |

|

04/10/2012 |

1.2013 |

1.2024 |

1.2030 |

1.2013 |

-0.09% |

|

04/09/2012 |

1.2024 |

1.2014 |

1.2025 |

1.2011 |

0.08% |

EUR continues to show resilience in the face of a challenged outlook, entering the NA session in the mid 1.31s. A dovish Fed has helped support EUR, even as European bond markets suggest building stresses and the Spanish IBEX has dropped to an almost four year low. Today, the Bank of Spain released their March statistics, which showed that the ECB increased its lending to Spanish banks from EUR152bn in February to EUR228bn in March, a new record. Suggesting that the banking system remains vulnerable and that if any of these loans were used to buy Spanish sovereign debt the increase in yields will be generating mark to market losses. Do not expect EUR to collapse lower, supported by a limit to how much the USD can rally without stifling the US recovery.

In other European news, inflation in Germany, Italy and Spain came in as expected providing some reassurance that next week’s Eurozone CPI will be close to the flash estimate of 2.6%. European finance ministers are hosting a May 2 meeting to discuss bank capital requirements

Major Economic Events for the past week actual v. forecast

|

Apr. 09 |

CNY |

Chinese CPI (YoY) |

3.6% |

3.3% |

3.2% |

|

Apr. 10 |

USD |

Fed Chairman Bernanke Speaks |

|||

|

JPY |

Interest Rate Decision |

0.10% |

0.10% |

0.10% |

|

|

JPY |

BoJ Press Conference |

||||

|

Apr. 12 |

Trade Balance |

0.3B |

2.0B |

2.0B |

|

|

USD |

Trade Balance |

-46.0B |

-52.0B |

-52.5B |

|

|

USD |

Initial Jobless Claims |

380K |

355K |

367K |

|

|

Apr. 13 |

CNY |

Chinese GDP (YoY) |

8.1% |

8.3% |

8.9% |

|

USD |

Core CPI (MoM) |

0.2% |

0.2% |

0.1% |

Historical

Highest: 1.5193 CHF on 10 Oct 2009.

Average: 1.3271 CHF over this period.

Lowest: 1.026 CHF on 10 Aug 2011.

Economic Highlights of the coming week that affect the Euro, GPB, and the Franc

|

Apr. 16 |

08:15 |

CHF |

PPI (MoM) |

0.8% |

|

Apr. 17 |

09:30 |

GBP |

CPI (YoY) |

3.4% |

|

10:00 |

EUR |

CPI (YoY) |

2.6% |

|

|

10:00 |

EUR |

Core CPI (YoY) |

1.5% |

|

|

Apr. 18 |

09:30 |

GBP |

Average Earnings Index +Bonus |

1.4% |

|

09:30 |

GBP |

Claimant Count Change |

7.2K |

|

|

Apr. 19 |

08:30 |

EUR |

Dutch Unemployment Rate |

6.00% |

|

Apr. 20 |

09:00 |

EUR |

German Ifo Business Climate Index |

109.8 |

|

09:00 |

EUR |

German Current Assessment |

117.4 |

|

|

09:00 |

EUR |

German Business Expectations |

102.7 |

|

|

09:30 |

GBP |

Retail Sales (MoM) |

-0.8% |

Government Bond Auctions (this week)

Apr 16-30 n/a UK Re-opened 3.75% 2052 Conventional Gilt syndication

Apr 16 09:10 Slovakia Auctions floating rate Nov 2016 & 4.35% Oct 2025 & Bonds

Apr 16 09:10 Norway T-bill auction

Apr 17 08:30 Spain 12 & 18M T-bill auction

Apr 17 09:30 Belgium Auctions 3 & 12M T-bills

Apr 18 09:10 Sweden Nominal bond auction

Apr 18 09:30 Germany Eur 5.0bn 0.25% Mar 2014 Schatz

Apr 18 14:30 Sweden Details T-bill auction on Apr 25

Apr 19 08:30 Spain Obligacion auction

Apr 19 08:50 France BTAN auction

Apr 19 09:30 UK Auctions 0.125% I/L Gilt 2029

Apr 19 09:50 France OATi auction

Originally posted here