By FXEmpire.com

EUR/CHF Weekly Fundamental Analysis April 9-13, 2012, Forecast

ntroduction: News from the Euro and Swiss zone. EUR/CHF is frequently chosen for carry trades which involves going long a high-yielding currency (EURO – 3.50%) against a low-yielding one (CHF – 1.50%). Traders earn daily interest fees when holding this pair long (rollover fees).

- The interest rate differential between the European Bank(ECB) and the Swiss National Bank(SNB)

- Swiss and Euro zone fundamentals

Analysis and Recommendations:

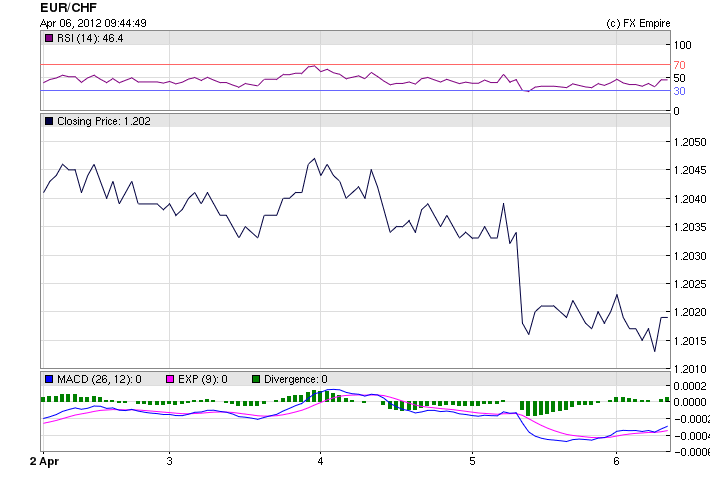

The EUR/CHF dropped below the floor set by the SNB briefly on Thursday touching as low as 1.1990 before it was immediately pushed back over. Rumors of intervention by the Swiss National Bank have not been confirmed.

The euro plunged midweek and continued to decline against most it is trading partners for the rest of the week. On Friday while markets were closed the US released a confusion NFP report, which has given the euro a bit of strength over the weekend. Many markets remain closed on Monday also

Disappointing economic data flowed all week. Spain introduced a tough new budget, which incorporated all the austerity measures demanded by the EU, but in reality would be difficult or impossible to implement.

Greece continued in the headlines, as worried about the necessity of a 3rd bailout became news.

Midweek, the US FOMC minutes were released throwing markets into turmoil. It was clear by the minutes that the FED has no plans of any additional monetary easing in any form. This made investors rethink values.

|

Date |

Open |

High |

Low |

Change % |

|

|

04/06/2012 |

1.2017 |

1.2020 |

1.2025 |

1.2012 |

-0.02% |

|

04/05/2012 |

1.2019 |

1.2034 |

1.2041 |

1.2000 |

-0.12% |

|

04/04/2012 |

1.2034 |

1.2047 |

1.2047 |

1.2031 |

-0.11% |

|

04/03/2012 |

1.2047 |

1.2038 |

1.2049 |

1.2032 |

0.07% |

|

04/02/2012 |

1.2037 |

1.2040 |

1.2048 |

1.2037 |

-0.02% |

|

04/01/2012 |

1.2040 |

1.2041 |

1.2046 |

1.2039 |

-0.01% |

Historical

Highest: 1.5193 CHF on 10 Oct 2009.

Average: 1.3271 CHF over this period.

Lowest: 1.026 CHF on 10 Aug 2011.

Economic Data from Europe for the week of April 2-6, 2012 actual v. forecast

|

Apr. 02 |

08:15 |

CHF |

Retail Sales (YoY) |

0.8% |

3.2% |

4.7% |

|

08:30 |

CHF |

SVME PMI |

51.1 |

49.5 |

49.0 |

|

|

08:50 |

EUR |

French Manufacturing PMI |

46.7 |

47.6 |

47.6 |

|

|

08:55 |

EUR |

German Manufacturing PMI |

48.4 |

48.1 |

48.1 |

|

|

09:00 |

EUR |

Manufacturing PMI |

47.7 |

47.7 |

47.7 |

|

|

09:30 |

GBP |

Manufacturing PMI |

52.1 |

50.5 |

51.5 |

|

|

10:00 |

EUR |

Unemployment Rate |

10.8% |

10.8% |

10.7% |

|

|

Apr. 03 |

10:00 |

EUR |

GDP (QoQ) |

-0.3% |

-0.3% |

-0.3% |

|

Apr. 04 |

08:00 |

GBP |

Halifax House Price Index (MoM) |

2.2% |

-0.3% |

-0.4% |

|

09:30 |

GBP |

Services PMI |

55.3 |

53.5 |

53.8 |

|

|

10:00 |

EUR |

Retail Sales (MoM) |

-0.1% |

0.1% |

1.1% |

|

|

11:00 |

EUR |

German Factory Orders (MoM) |

0.3% |

1.2% |

-1.8% |

|

|

12:45 |

EUR |

Interest Rate Decision |

1.00% |

1.00% |

1.00% |

|

|

13:30 |

EUR |

ECB Press Conference |

||||

|

Apr. 05 |

08:15 |

CHF |

CPI (MoM) |

0.6% |

0.4% |

0.3% |

|

08:30 |

EUR |

Dutch CPI (YoY) |

2.50% |

2.20% |

2.50% |

|

|

09:30 |

GBP |

Industrial Production (MoM) |

0.4% |

0.3% |

-0.6% |

|

|

09:30 |

GBP |

Manufacturing Production (MoM) |

-1.0% |

0.1% |

-0.3% |

|

|

12:00 |

GBP |

Interest Rate Decision |

0.50% |

0.50% |

0.50% |

|

|

12:00 |

GBP |

BOE QE Total |

325B |

325B |

325B |

|

|

15:00 |

GBP |

NIESR GDP Estimate |

0.1% |

0.0% |

Economic Event: (GMT)

Economic Highlights of the coming week that affect the Euro, the USD and the Franc

|

Apr. 10 |

00:01 |

GBP |

RICS House Price Balance |

-13% |

|

06:45 |

CHF |

Unemployment Rate |

3.1% |

|

|

Apr. 12 |

06:30 |

EUR |

French CPI (MoM) |

0.4% |

|

08:30 |

EUR |

Dutch Retail Sales (YoY) |

0.80% |

|

|

09:30 |

GBP |

Trade Balance |

-7.5B |

|

|

10:00 |

EUR |

Industrial Production (MoM) |

0.2% |

|

|

10:00 |

EUR |

Portuguese CPI (MoM) |

0.10% |

|

|

10:00 |

EUR |

Greek Unemployment Rate |

21.00% |

|

|

Apr. 13 |

07:00 |

EUR |

German CPI (MoM) |

0.3% |

|

07:00 |

EUR |

Finnish CPI (YoY) |

3.10% |

|

|

09:30 |

GBP |

PPI Input (MoM) |

2.1% |

Originally posted here