By FXEmpire.com

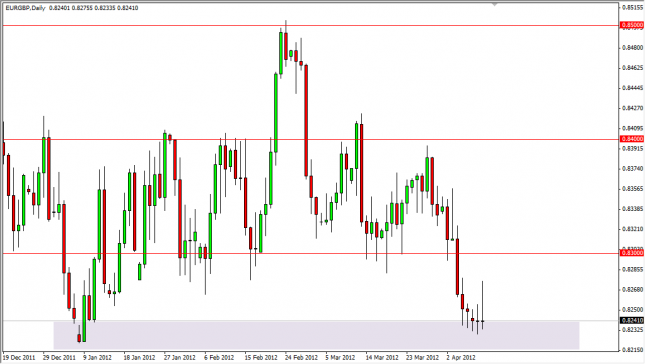

The EUR/GBP pair initially rose during the session on Tuesday, but fell back down to form a shooting star at the bottom of the recent range. The failure to gain traction by the bulls is a telling sign, and it now looks like the 0.82 level will be giving way soon. With this in mind, we are only more convinced that selling this pair is still the way to go.

A break below the handle at 0.82 would signal a move lower and perhaps down to the 0.80 level in the medium term. The market is certainly against the Euro at the moment, and selling it is the only way to go against almost all currencies. The market for this pair has been decidedly negative over the recent weeks, and as a result we are looking to sell.

A rally higher would more than likely find resistance at the 0.83 level, and we would be more than willing to sell at that point if the candle was weak. The fall in this pair could be swift if something negative happens in Europe, but the natural “flow” of this pair is to grind, so if you are selling you should be prepared to be patient. The pair will often grind for ages, but with a bias. We believe this is the kind of market we are entering. After all, the United Kingdom is heavily dependent on the European Union for trade, and because of this – the failure in Europe will also be a partial failure in the United Kingdom.

The pair will be a great barometer of strength in each currency, and is a favorite of many traders to distinguish between the two currencies. In other words, they will often see which one is stronger, and then buy it against the Dollar. (Or vice versa.) Not only can you sell the rallies or a break lower, this pair should also show you which currency to sell against the Dollar as we enter a bearish “risk off” type of market in the immediate future.

EUR/GBP Forecast April 11, 2012, Technical Analysis

Originally posted here