By FX Empire.com

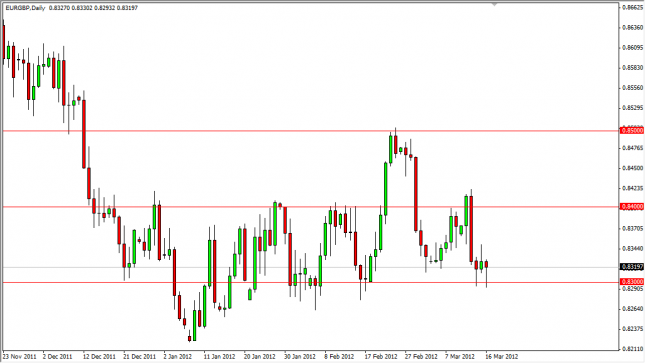

The EUR/GBP pair fell for the session on Friday as the Euro slid against the Pound. The European Union is more than likely going to slip into recession in various places, and there are still plenty of potential landmines to be found in that region. The last three sessions have seen a hammer, a shooting star, and another hammer form just above the 0.83 support area, and this shows just how important this area is going to be going forward for this pair as the market is in a real battle at this point.

The market will have to decide if the European problems are worse than expected, and in order to express this in this pair, break down below the 0.83 level which has been so stubborn as of late.

The breaking down of this level is actually the trade we prefer. While no big fan of the pound, we certainly don’t want to buy the Euro unless something fundamentally changes in the European Union. The Portuguese bond markets are still yielding extraordinarily high rates, so the markets certainly don’t have a lot of faith in that country either. We could be looking at the next train wreck in Europe.

The move would continue a downtrend that has been forming for some time in our eyes. It should also be said that the median price in this pair is 0.80, so this is where we think the market goes eventually. In the meantime however, we have to respect the moves. So if we get a breakout to the upside, we would have to begrudgingly go with it, but won’t do so until we see the 0.85 level broken as it would show a resurgence of strength in this pair.

The Pound will continue to be weak overall in our opinion as well, but mainly because of the proximity to Europe. In other words, this pair will be slow moving as it really is a matchup between two weak currencies. With this in mind, we want to sell on a daily close below the 0.83 level, but would also consider selling rallies unless they manage to close above the 0.85 handle.

EUR/GBP Forecast March 19, 2012, Technical Analysis

Originally posted here